Arundhati Roy, in a series of interviews with David Barsamian that were complied and published in a book entitled "The Checkbook and the Cruise Missile", when talking of the Indian judiciary, said that : "You cannot have an undemocratic institution in a Democracy, as it works as a sort of black hole into which all unaccountable power flows. All decisions are then made by that Institution, because it's the one institution whose policies cannot be questioned."

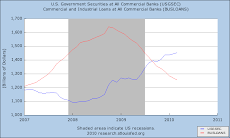

This calls to mind two things. First, Dick Cheney, the only Vice President who no one ever voted for, as he was nothing more than a party apparatchik who foisted himself onto the Bush ticket, without ever having run for public office. Then once in, he attempted to make his actions unaccountable by maintaining that he was part of neither the executive nor legislative branch of government. Which brings up the second thing: now Bernanke is up to the same trick. Claiming that his “ability to take actions without engendering sharp increases in inflation depend heavily on his independence from short-term political pressures”, he has not only fought attempts by Congress to audit the Fed (despite the fact that The Constitution of the United States empowers the Congress "to coin money [and] regulate the value thereof"), but tried to usurp even more power to the institution, and himself, at the height of the financial crisis last year (exactly as Naomi Klein's "The Shock Doctrine" predicted he would).

Having called the 2004-2007 super bubble the "great moderation", claiming it was brought about by his own superior monetary policies, now that it's burst, spewing caustic lye on everyone's pension savings, and home values, corroding them and their hopes of ever retiring, he washes his hands of any responsibility for the mess that he created during his acid reign, but is completely incapable of "mopping up". He claims that should the very Congress, empowered by the Constitution to coin money and regulate its value, influence monetary policy decisions, it would "undermine the confidence the public and the markets have in the Fed to act in the long-term economic interest of the nation.” But neither does the public have any such confidence, nor do the actions of the Fed for more than a generation been in the interest of any but a small minority of the nation: the denizens of Wall St., who, by their own screed, have nobody's interest in mind but their own, and who hold that if you do give a damn about anyone else, it undermines one's effectiveness. Only when everyone acts in their own selfish interest can the Markets work.

Yet even though all these reasons would make Bernanke unacceptable as Fed Chairman, the tantamount reason is that he is either a liar or a fool, and quite possibly both. Like his predecessor, he thinks that reflating house values and rekindling the mania that caused the collapse of the house of cads in the first place will solve the nation's economic woes. We can then continue merrily shipping jobs overseas and continue our utter dependency on a transportation system that gets more and more onerous and untenable by the day. Not once has the Chairman addressed the underlying economic impossibility of sustaining a consumer-driven economy on the backs of a labor force that competes with Asian peasants ripped from their agricultural lands and herded into cities to work for slave wages who have no home or car payments, no impossibly expensive medical infrastructure or social security, or workman's comp, or unemployment insurance burden, no War Machine, whose fuel needs alone equal those of the entire nation of Sweden, and no Wars, from Drug Wars to Wars on terror, to increase the interest penalty the government pays on its escalating national debt year after year.

There is no recovery, can be no recovery, because things must be allowed to fail before they can recover. Instead all the monetary resources needed to fuel a recovery are, continue to be, squandered on misallocation of capital to sustain atavistic dreams of full-spectrum domination of a minority of mankind over the rest of the planet when it can't even sustain itself without economic legerdemain and financial malfeasance. A status quo Mr. Bernanke is intent on maintaining even though his ability to do so is woefully inadequate.

Perhaps even without a new chairman, the Fed's dual task of stimulating the nation's economy while simultaneously promising a strong Dollar policy would be impossible. But, as even CEO's in the private sector have to resign when their incompetence is so glaringly manifest, it is time to rid the Government of this last vestige of the Bush years, and give someone with credibility a chance.

The WSJ printed an article today that shows the Chairman for the liar he is:

"For gold and oil, Bernanke's low-rate policy works, weakening the dollar so commodity prices go up and providing traders with ample funds to buy into the expanding bubble. But for small businesses and new workers, capital rationing is devastating, spelling business failures and painful layoffs. Thousands of start-ups won't launch due to credit shortages, in part because the government and corporations took more credit than they needed (because it was so cheap).

Under emergency stimulus, corporations are borrowing dollars hand-over-fist, pleasing Wall St. while using the proceeds to expand their foreign businesses. In a more market-oriented allocation of global capital, the U.S. will be a big winner, especially for jobs and small businesses.

The Street utterly loves the Fed's largess, (under Bernanke) earning massive profits from trading unstable currencies, the carry trade (borrow short-term dollars near zero, buy longer-term assets abroad), and the high-margin process of transferring America's capital abroad. (Bingo!)

The hitch is that there isn't much trickle-down to normal jobs and small businesses from the sophisticated, zero-rate arbitrage that is propelling asset prices ever higher."

That capital they speak of comes from the same place all capital comes from, the savings of labor. And those asset prices Bernanke's policy is pushing up are the prices of houses that, together with the downward pressure on wages, pushes them further and further out of workers' reach. There can only be one end to this, and it won't be pretty, but the reaction of Bernanke is completely predictable ... as the stimulus works to provide an anemic recovery, it'll be because of his astute management, and when it comes crashing to the ground, it will be everyone's fault but his own; ...oh... and could you please cash this check? It's for the next million bucks I'll collect for the "great mode: rationing" that the economy will descend into by the time I'm through with it.