Despite crippling losses in 2008, employees at financial companies in New York collected an estimated $18.4 billion in bonuses for the year.

Without a single Republican vote, President Obama won House approval for an $819 billion economic plan some companies found a loophole to increase a CEO’s pension by 10% to 40% – even as those very same companies slash pensions for their employees, The Wall Street Journal reported.

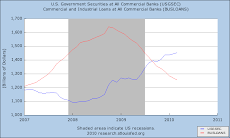

The fund (IMF) said that credit losses from bad assets originating in the US would be $2,200bn (€1,662bn, £1,537bn), a sharp increase from its previous $1,400bn estimate.

Banks would be likely to need at least half a trillion dollars in new capital over the next two years simply to prevent their capital position deteriorating further.

(Reuters) - U.S. government officials seeking to revamp the financial bailout have discussed spending another $1 trillion to $2 trillion to help restore banks to health, the Wall Street Journal said, citing people familiar with the matter.

federal regulators on Wednesday guaranteed $80 billion in uninsured deposits at the powerful institutions that service the nation's credit unions. Regulators also injected $1 billion of new capital into the largest of these wholesale credit unions, U.S. Central Federal Credit Union of Lenexa, Kan., after the firm on Wednesday posted an unexpected $1.1 billion loss for 2008. U.S. Central serves essentially as a main clearinghouse for the others in the network.

Officials are wrestling with how to privatize the gains and socialize the losses.

Geithner is the worst of Obama's picks.

California State Teachers' Retirement System, own 10 office buildings in Austin, including the Frost Bank Tower downtown.

The commercial real estate mess is just beginning. Uncollected tax bills are going to soar, and many small to mid-sized regional banks heavily into commercial real estate are headed for bankruptcy.

Hess reports a 4Q08 loss in the oil refining business. Boeing blamed their 4Q08 loss on the unions. Wells Fargo dropped $2.6 billion, which it blames on paying too much or Wachovia. Elsewhere, money sent home by Mexican guests working in the US declined for the first time ever.

The Executive Director of the UN Office on Drugs and Crime is quoted as saying "In many instances, drug money is currently the only liquid investment capital".

Europe's third-largest oil producer Total SA (ADR:TOT), offered $503 million to buy UTS Energy Corp., a Canadian oil-sands explorer. If UTS and its shareholders accept, it'd be Total's third acquisition of unconventional assets since July, Bloomberg reported. UTS shares rose more than 95% on the Toronto exchange on the news.

The Chinese premier, Wen Jiabao, left little doubt that Beijing blamed the United States for the economic breakdown. “Inappropriate macroeconomic policies,” an “unsustainable model of development characterized by prolonged low savings and high consumption,” the “blind pursuit of profit” and “the failure of financial supervision” all contributed, he said.

The most panicky of all, Mr. Roach said, are American consumers, who are retrenching after a decade-long binge fed by inflated housing prices. He predicted that they were only “20 percent into a multiyear” adjustment that would leave them much more frugal.

As many as 40 of the biggest 100 buyout firms may collapse by 2011 as their debt-strapped assets default, according to a 2008 report by Boston Consulting Group Inc., which didn’t identify the firms in its study.

IMF in January 2009 expects total writedowns on U.S. originated assets to reach at least $2.2 trillion from the current $1 trillion (projected as recently as Oct.'09). Raising the needed amount of capital will be difficult going forward--> IMF estimates global capital shortfall of $500 bn forces banks globally to contract credit by a multiple of that amount (i.e. about 4-5 trillion using Greenlaw/Shin/Hatzius/Kashyap methodology) --> we're only half-way through.

FDIC: Fraud Delivers Inexcusable Criminality.

FOMC: Feds Orchestrate Machiavellian Coup d'Etat.

Thursday, January 29, 2009

Wednesday, January 28, 2009

Capitalism is Criminality: POP go the weasels.

Agape World Inc. of Long Island, N.Y., and Carolina Development from Orange County, Ca. The two faux firms fleeced some 2,500 investors for over $430 million.

Valero Energy said it would close an entire US refinery this quarter as it slashes petrol production and sharply reduces capital spending to manage the economic slowdown, the Financial Times is reporting.

The biggest US refiner has 15 refineries across the country. It said that in addition to shutting its large Texas City refinery, it would close the fluid catalytic cracking unit, which primarily produces petrol, at its Corpus Christi East Plant.

“The sluggish economy is clearly a headwind against demand growth for refined products,’’ said Bill Klesse, Valero’s chairman and chief executive.

Valero Energy Corp (VLO.N) could permanently shut those of its 15 North American refineries it no longer wants to own but may not be able to sell in the current economic downturn, Chairman and Chief Executive Bill Klesse said on Tuesday.

"If you don't want them and you can't sell them, I guess the answer would be yes," Klesse said to an analyst who asked if undesirable refineries might be permanently shut.

Valero has identified its Memphis and Aruba refineries as plants it would like to sell.

Valero also cut its estimate for 2009 capital spending to $2.7bn from its previous estimate of $3.5bn. Analysts had been expecting more than $4bn in capital spending for 2009. The company said that the cut in planned expenditure would have an impact on discretionary projects at many of its refineries.

US drilling services company Rowan Companies Inc. announced today that the company is canceling the construction of one jackup and suspending the construction of two others. In an unscheduled report to investors, Rowan announced a plan to reduce the company's expenditures through newbuild plan revisions. These newbuild construction revisions have allowed Rowan to keep its estimated 2009 capex between $550 to $575 million.

Although, with the banking collapse being all the rage, and decoupling theories finally receiving their deserved scorn, with some left over for the debunking of the theory that the CRE (commercial real estate) bubble would sustain the economy, no mention has been made of the Capex (capital expenditure) boom that was predicted to uphold the economies of the world as the dis-credit-ed bubble and its concomitant housing bubble lost hot air.

These articles, together with many others appearing in the last weeks and months, of major corporations cutting back on capex spending in the face of recessionary forces, should debunk the myth of capex spending coming to the economy's rescue.

Meanwhile, at the banks: "The situation is so extreme and beyond what we've seen in past cycles that management teams are becoming reluctant to predict the relationship between unemployment and credit losses," said Kevin Fitzsimmons, analyst at Sandler O'Neill & Partners.

The Washington Independent notes that Analysts Fear $1 Trillion Credit Card Market Could Be Next Crash.

According to a Bloomberg analysis incorporating data from the Treasury Department and Federal Deposit Insurance Corp. (FDIC) and interviews with regulatory officials and others:

* $300 billion has been spent on Fannie Mae, Freddie Mac (FRE), American International Group Inc. (AIG) and Bear Stearns Cos. (now part of JP Morgan Chase & Co. (JPM).

* $300 billion on Citigroup.

* $700 billion on TARP - though not on what TARP was intended for.

* $800 billion on Fed-directed asset-backed debt-purchase programs.

* $1.4 trillion on FDIC bank guarantees.

* $2.3 trillion on Fed commercial paper programs.

* And $2.2 trillion on other Fed lending and government commitments.

That totals a little bit more than $8.5 trillion.

Throwing good taxpayer money after badly wasted taxpayer money will not fix anything. But throwing out overly leveraged, overly greedy, overly dependent banks and bankers is a good start. But not enough...as Iceland's proven.

It must be recognized and acknowledged that Capitalism is Criminality...there is no difference,

it's merely sanctioned by government, making the behavior un-criminal, legally.

Whereas elevating greed to the height of virtue while simultaneously putting in strong regulations and JAIL-time penalties is one thing, to elevate Greed while removing those penalties and stoking it to a hot flame of mania isn't just inviting criminality, it's sanctioning it, even enforcing it. Because when your competitors take advantage of the lax environment, thereby making outsize profits that consequently entices your shareholders to become their shareholders, you are not fulfilling your fiduciary responsibilities and the sacrosanct marketplace will destroy you.

So for all the sanctimonious denial and hypocritical "How could anybody see this coming?", every economist who actually was one knew this. But every economist simply rolled over and became just a toady for their so-called educational institution or government agency that was raking in the dough as they promised their regulators juicy, multi-million dollar jobs after they've finished what they maddeningly refer to as government "service".

Such service in a restaurant would amount to you seating yourself, getting up and getting your own food and drink, clearing your own table, seating the next patron and then leaving your credit card with the Maitre d'.

"Forty percent of the world's wealth was destroyed in last five quarters. It is an almost incomprehensible number," said Stephen Schwarzman, chairman of the leading private equity company Blackstone Group.

Stephen Roach, Morgan Stanley's Asia chairman, agreed the next three years would be tough:

"The concept of a vigorous 'V'-shaped recovery is for business cycles of the past but not for this post-bubble, post-crisis business cycle. It is going to be a long slog in 2010, in 2011," he told Reuters.

The UK's third largest supermarket chain, Sainsbury's Supermarkets, announced plans today to use its unsold food in Scotland to power a biomass plant near Motherwell, about 15 miles southeast of Glasgow.

The chain's 28 stores in Scotland send 42 metric tons of waste to landfills each week. The effort would divert the waste and produce enough power for a town the size of Inverness, which has a population over more than 50,000. The chain said each metric ton could power 500 homes. The UK has long been criticized for its food waste. A report last year from the government-funded Waste and Resources Action Programme showed that 6.7 million metric tons of food is thrown out in the UK each year, half of which is food that is unopened or untouched.

This is the Capitalist's dream. Food being discarded while barges return to the East empty to the starving millions of the world. And this is at its best. Watch what the future has in store, and remember that we threw away food by the mega-ton while people starved and churches stoked them to ever greater birthrates.

The base of the Statue of Liberty reads:

"Give me your tired, your poor,

Your huddled masses yearning to breathe free,

The wretched refuse of your teeming shore.

Send these, the homeless, tempest-tost to me,

Forgotten is the fact that these huddled masses were created by the most successful economies in the World, awash in gold and stuffed with foods and spices and drugs from around the world produced by slave labor, making their own citizens so much surplus. Blind are we to the fact that the return to the slave economies of the 18'th century occurred right under our upturned noses while we were bought off with cheap credit, mansions we couldn't afford, and chariots that suck down petrol like it's coca cola.

While the USA worked hand-in-hand with China's totalitarian government to shoot down its dissidents so that its population could be brought by cattle car into its sweatshops to make our sweatshirts, with US chanting, "they sweat, we think", the Cheneys and the Carlysle Groups (i.e., the Bushes) and Blackstone, and Paladins of the world, all oil and defense men (ie living on government guarantees), who knew the POP (Peak Oil Production) of the credit bubble would be the end of the world as we know it, would have us all so mired in debt and enslaved by our inability to ever work our way out from under it, have been simply playing us for suckers on the largest scale in human history.... Madoff was a 2-bit hack, completely off the radar screen because the malfeasance on all levels of government completely dwarfed his crimes...and we're still, for the most part, still laboring under the self-inflicted blindness of a delusional citizenry that hypnotizes itself into the belief that the US government is "for" the people.

Well, alright it is. It is for the Rich people.

Capitalism is and always has been designed to create scarcity and enrich and protect a small elite. WW2 forced their hand into sharing the enormous wealth generated by the American economy after the US military carried out the plan of the upper class elite to utterly destroy the productive capacity of the German and Japanese economies. That, however was an aberration. We are now returning to the planned economy Capitalists favor where the uneducated masses are forced to come on bended knees to beg for credit for their education and healthcare in order to be admitted into the high citadels of finance and Government jobs to join the ranks of those who hold sway over the rest of the population that 's prostrate before it. This is what Ike warned about when he warned of mankind hanging on a cross of iron.

The difference is Ike saw this as a bad thing. Today's Upper Class see it as the only answer to POP, which they deride even as they build walls around themselves against its inevitable occurrence. POP was reached in 2005. Since then the world has produced less oil year after year, and will continue to do so into the foreseeable future...make no mistake about it.

This was the reason the Reagan revolution was started and has continued through Democratic and Republican administrations. The West brags it rode to victory in WWII on a wave of oil, and the rich intend to surf on that wave while crushing the rest of mankind beneath it.

If you disbelieve this, then just look at the nature of the States which are buying our debt: the Gulf States and the Chinese. Just as Germany and Japan were forced to remake their economies in the image of the US, so the US elite have forced the American people into the position where we owe our very existence to either totalitarian Communists or anti-gay, anti-women, anti-democratic Sheikdoms. Those are the rulers the US will be kowtowing to more and more as we move into the future, because we have blindly and, deaf to all warnings, placed our economy's, and therefore our country's, future into their hands. The end of the Bush Regime brought the final push into completely unsalvageable hopelessness, following the script laid out in Naomi Klein's "Disaster Capitalism" and followed so well in other economies, such as South Africa's, and pushed by such Chicago School acolytes as Rumsfeld.

If you have not gotten a whiff of the stench of betrayal with which the Uber-Rich are rife, it is merely because along with your senses of sight and hearing, your sense of smell has atrophied as well.

Valero Energy said it would close an entire US refinery this quarter as it slashes petrol production and sharply reduces capital spending to manage the economic slowdown, the Financial Times is reporting.

The biggest US refiner has 15 refineries across the country. It said that in addition to shutting its large Texas City refinery, it would close the fluid catalytic cracking unit, which primarily produces petrol, at its Corpus Christi East Plant.

“The sluggish economy is clearly a headwind against demand growth for refined products,’’ said Bill Klesse, Valero’s chairman and chief executive.

Valero Energy Corp (VLO.N) could permanently shut those of its 15 North American refineries it no longer wants to own but may not be able to sell in the current economic downturn, Chairman and Chief Executive Bill Klesse said on Tuesday.

"If you don't want them and you can't sell them, I guess the answer would be yes," Klesse said to an analyst who asked if undesirable refineries might be permanently shut.

Valero has identified its Memphis and Aruba refineries as plants it would like to sell.

Valero also cut its estimate for 2009 capital spending to $2.7bn from its previous estimate of $3.5bn. Analysts had been expecting more than $4bn in capital spending for 2009. The company said that the cut in planned expenditure would have an impact on discretionary projects at many of its refineries.

US drilling services company Rowan Companies Inc. announced today that the company is canceling the construction of one jackup and suspending the construction of two others. In an unscheduled report to investors, Rowan announced a plan to reduce the company's expenditures through newbuild plan revisions. These newbuild construction revisions have allowed Rowan to keep its estimated 2009 capex between $550 to $575 million.

Although, with the banking collapse being all the rage, and decoupling theories finally receiving their deserved scorn, with some left over for the debunking of the theory that the CRE (commercial real estate) bubble would sustain the economy, no mention has been made of the Capex (capital expenditure) boom that was predicted to uphold the economies of the world as the dis-credit-ed bubble and its concomitant housing bubble lost hot air.

These articles, together with many others appearing in the last weeks and months, of major corporations cutting back on capex spending in the face of recessionary forces, should debunk the myth of capex spending coming to the economy's rescue.

Meanwhile, at the banks: "The situation is so extreme and beyond what we've seen in past cycles that management teams are becoming reluctant to predict the relationship between unemployment and credit losses," said Kevin Fitzsimmons, analyst at Sandler O'Neill & Partners.

The Washington Independent notes that Analysts Fear $1 Trillion Credit Card Market Could Be Next Crash.

According to a Bloomberg analysis incorporating data from the Treasury Department and Federal Deposit Insurance Corp. (FDIC) and interviews with regulatory officials and others:

* $300 billion has been spent on Fannie Mae, Freddie Mac (FRE), American International Group Inc. (AIG) and Bear Stearns Cos. (now part of JP Morgan Chase & Co. (JPM).

* $300 billion on Citigroup.

* $700 billion on TARP - though not on what TARP was intended for.

* $800 billion on Fed-directed asset-backed debt-purchase programs.

* $1.4 trillion on FDIC bank guarantees.

* $2.3 trillion on Fed commercial paper programs.

* And $2.2 trillion on other Fed lending and government commitments.

That totals a little bit more than $8.5 trillion.

Throwing good taxpayer money after badly wasted taxpayer money will not fix anything. But throwing out overly leveraged, overly greedy, overly dependent banks and bankers is a good start. But not enough...as Iceland's proven.

It must be recognized and acknowledged that Capitalism is Criminality...there is no difference,

it's merely sanctioned by government, making the behavior un-criminal, legally.

Whereas elevating greed to the height of virtue while simultaneously putting in strong regulations and JAIL-time penalties is one thing, to elevate Greed while removing those penalties and stoking it to a hot flame of mania isn't just inviting criminality, it's sanctioning it, even enforcing it. Because when your competitors take advantage of the lax environment, thereby making outsize profits that consequently entices your shareholders to become their shareholders, you are not fulfilling your fiduciary responsibilities and the sacrosanct marketplace will destroy you.

So for all the sanctimonious denial and hypocritical "How could anybody see this coming?", every economist who actually was one knew this. But every economist simply rolled over and became just a toady for their so-called educational institution or government agency that was raking in the dough as they promised their regulators juicy, multi-million dollar jobs after they've finished what they maddeningly refer to as government "service".

Such service in a restaurant would amount to you seating yourself, getting up and getting your own food and drink, clearing your own table, seating the next patron and then leaving your credit card with the Maitre d'.

"Forty percent of the world's wealth was destroyed in last five quarters. It is an almost incomprehensible number," said Stephen Schwarzman, chairman of the leading private equity company Blackstone Group.

Stephen Roach, Morgan Stanley's Asia chairman, agreed the next three years would be tough:

"The concept of a vigorous 'V'-shaped recovery is for business cycles of the past but not for this post-bubble, post-crisis business cycle. It is going to be a long slog in 2010, in 2011," he told Reuters.

The UK's third largest supermarket chain, Sainsbury's Supermarkets, announced plans today to use its unsold food in Scotland to power a biomass plant near Motherwell, about 15 miles southeast of Glasgow.

The chain's 28 stores in Scotland send 42 metric tons of waste to landfills each week. The effort would divert the waste and produce enough power for a town the size of Inverness, which has a population over more than 50,000. The chain said each metric ton could power 500 homes. The UK has long been criticized for its food waste. A report last year from the government-funded Waste and Resources Action Programme showed that 6.7 million metric tons of food is thrown out in the UK each year, half of which is food that is unopened or untouched.

This is the Capitalist's dream. Food being discarded while barges return to the East empty to the starving millions of the world. And this is at its best. Watch what the future has in store, and remember that we threw away food by the mega-ton while people starved and churches stoked them to ever greater birthrates.

The base of the Statue of Liberty reads:

"Give me your tired, your poor,

Your huddled masses yearning to breathe free,

The wretched refuse of your teeming shore.

Send these, the homeless, tempest-tost to me,

Forgotten is the fact that these huddled masses were created by the most successful economies in the World, awash in gold and stuffed with foods and spices and drugs from around the world produced by slave labor, making their own citizens so much surplus. Blind are we to the fact that the return to the slave economies of the 18'th century occurred right under our upturned noses while we were bought off with cheap credit, mansions we couldn't afford, and chariots that suck down petrol like it's coca cola.

While the USA worked hand-in-hand with China's totalitarian government to shoot down its dissidents so that its population could be brought by cattle car into its sweatshops to make our sweatshirts, with US chanting, "they sweat, we think", the Cheneys and the Carlysle Groups (i.e., the Bushes) and Blackstone, and Paladins of the world, all oil and defense men (ie living on government guarantees), who knew the POP (Peak Oil Production) of the credit bubble would be the end of the world as we know it, would have us all so mired in debt and enslaved by our inability to ever work our way out from under it, have been simply playing us for suckers on the largest scale in human history.... Madoff was a 2-bit hack, completely off the radar screen because the malfeasance on all levels of government completely dwarfed his crimes...and we're still, for the most part, still laboring under the self-inflicted blindness of a delusional citizenry that hypnotizes itself into the belief that the US government is "for" the people.

Well, alright it is. It is for the Rich people.

Capitalism is and always has been designed to create scarcity and enrich and protect a small elite. WW2 forced their hand into sharing the enormous wealth generated by the American economy after the US military carried out the plan of the upper class elite to utterly destroy the productive capacity of the German and Japanese economies. That, however was an aberration. We are now returning to the planned economy Capitalists favor where the uneducated masses are forced to come on bended knees to beg for credit for their education and healthcare in order to be admitted into the high citadels of finance and Government jobs to join the ranks of those who hold sway over the rest of the population that 's prostrate before it. This is what Ike warned about when he warned of mankind hanging on a cross of iron.

The difference is Ike saw this as a bad thing. Today's Upper Class see it as the only answer to POP, which they deride even as they build walls around themselves against its inevitable occurrence. POP was reached in 2005. Since then the world has produced less oil year after year, and will continue to do so into the foreseeable future...make no mistake about it.

This was the reason the Reagan revolution was started and has continued through Democratic and Republican administrations. The West brags it rode to victory in WWII on a wave of oil, and the rich intend to surf on that wave while crushing the rest of mankind beneath it.

If you disbelieve this, then just look at the nature of the States which are buying our debt: the Gulf States and the Chinese. Just as Germany and Japan were forced to remake their economies in the image of the US, so the US elite have forced the American people into the position where we owe our very existence to either totalitarian Communists or anti-gay, anti-women, anti-democratic Sheikdoms. Those are the rulers the US will be kowtowing to more and more as we move into the future, because we have blindly and, deaf to all warnings, placed our economy's, and therefore our country's, future into their hands. The end of the Bush Regime brought the final push into completely unsalvageable hopelessness, following the script laid out in Naomi Klein's "Disaster Capitalism" and followed so well in other economies, such as South Africa's, and pushed by such Chicago School acolytes as Rumsfeld.

If you have not gotten a whiff of the stench of betrayal with which the Uber-Rich are rife, it is merely because along with your senses of sight and hearing, your sense of smell has atrophied as well.

Tuesday, January 27, 2009

Still no talk about Peak Oil production: it peaked in 2005.

In a barely noticed move, the administration is funding the so-called "smart-grid" concept to increase efficiency of electricity delivery...or so the purported reason.

But, as with telephony, the real reason is that consumers can then be socked with outlandish energy bills because they had the audacity to run their dryers in the middle of the day instead of at midnight when demand is low.

....The state now looms far larger in many parts of Britain than it did in former Soviet satellite states such as Hungary and Slovakia as they emerged from communism in the 1990s, when state spending accounted for about 60% of their economies.

....Countries struggling to secure credit have resorted to barter and secretive government-to-government deals to buy food, with some contracts worth hundreds of millions of dollars. countries including Russia, Malaysia, Vietnam and Morocco say they have signed or are discussing inter-government and barter deals to import commodities from rice to vegetable oil. The countries have not disclosed the value of any deals, and some have refused even to confirm their existence. Officials estimated that they ranged from $5m for smaller contracts to more than $500m for the biggest. While food prices have fallen from their record high last year, this fall is only temporary, a study by Chatham House, the London-based think-tank, suggests.

...."Among the banks advising Pfizer and arranging a loan package to finance part of the purchase price are Bank of America Corp., Barclays Plc, Citigroup Inc., Goldman Sachs Group Inc., and JPMorgan Chase & Co., said people with knowledge of those banks’ roles."

So here's the bottom line. The taxpayer has kept BofA, Citigroup, Goldman Sachs and JP Morgan alive with TARP money and other goodies. Now these same firms are going ahead and "arranging a loan package" that will keep Pfizer's earnings up (maybe) with mass layoffs in a transaction so large that it will of necessity be anti-competitive even if OK with Justice (which it will be).

...Ironic, then, that, as the conservative era ended in the US in 2008, it culminated with an explosion of permissiveness and irresponsibility that made the free-love hippies of the 1960s look like Southern Baptist preachers. After all, the hippies never cost the American nation over one trillion dollars...now estimated to be more than $3.2 trillion.

Caterpillar to cut 20,000 jobs, Home Depot 7,000, Starbucks 1,000, Sprint 8,000, Microsoft 5,000, Intel 6,000, Ericsson 5,000, IBM 2,800, Eaton 5,200, Clear Channel 1,800, Bose 1,000, Pfizer 8,000, Deere 700, TI 3,400, Philips 6,000, ING 7,000, GM 2,000. The privates sector takes it in the balls..

Emperor penguins - those of Marching fame - are headed for extinction as the sea ice they depend on is disappearing faster than they can evolve to meet the change.

Warren Buffett observed that the world airline industry has not made a dime for investors in a century of manned flight.

There is not one major funded retirement program intact thanks to the manufacturers and distributors of OTC derivatives. The unfunded ones are a total loss. Retirement in the future is totally out of the question. Many now retired will end up in the same situation as those trying to live off fixed income. Both categories are being culled from the human gene pool.

The average Merrill employee got $247,423 in compensation and benefits in 2008: avg BofA? $75g's.

But, as with telephony, the real reason is that consumers can then be socked with outlandish energy bills because they had the audacity to run their dryers in the middle of the day instead of at midnight when demand is low.

....The state now looms far larger in many parts of Britain than it did in former Soviet satellite states such as Hungary and Slovakia as they emerged from communism in the 1990s, when state spending accounted for about 60% of their economies.

....Countries struggling to secure credit have resorted to barter and secretive government-to-government deals to buy food, with some contracts worth hundreds of millions of dollars. countries including Russia, Malaysia, Vietnam and Morocco say they have signed or are discussing inter-government and barter deals to import commodities from rice to vegetable oil. The countries have not disclosed the value of any deals, and some have refused even to confirm their existence. Officials estimated that they ranged from $5m for smaller contracts to more than $500m for the biggest. While food prices have fallen from their record high last year, this fall is only temporary, a study by Chatham House, the London-based think-tank, suggests.

...."Among the banks advising Pfizer and arranging a loan package to finance part of the purchase price are Bank of America Corp., Barclays Plc, Citigroup Inc., Goldman Sachs Group Inc., and JPMorgan Chase & Co., said people with knowledge of those banks’ roles."

So here's the bottom line. The taxpayer has kept BofA, Citigroup, Goldman Sachs and JP Morgan alive with TARP money and other goodies. Now these same firms are going ahead and "arranging a loan package" that will keep Pfizer's earnings up (maybe) with mass layoffs in a transaction so large that it will of necessity be anti-competitive even if OK with Justice (which it will be).

...Ironic, then, that, as the conservative era ended in the US in 2008, it culminated with an explosion of permissiveness and irresponsibility that made the free-love hippies of the 1960s look like Southern Baptist preachers. After all, the hippies never cost the American nation over one trillion dollars...now estimated to be more than $3.2 trillion.

Caterpillar to cut 20,000 jobs, Home Depot 7,000, Starbucks 1,000, Sprint 8,000, Microsoft 5,000, Intel 6,000, Ericsson 5,000, IBM 2,800, Eaton 5,200, Clear Channel 1,800, Bose 1,000, Pfizer 8,000, Deere 700, TI 3,400, Philips 6,000, ING 7,000, GM 2,000. The privates sector takes it in the balls..

Emperor penguins - those of Marching fame - are headed for extinction as the sea ice they depend on is disappearing faster than they can evolve to meet the change.

Warren Buffett observed that the world airline industry has not made a dime for investors in a century of manned flight.

There is not one major funded retirement program intact thanks to the manufacturers and distributors of OTC derivatives. The unfunded ones are a total loss. Retirement in the future is totally out of the question. Many now retired will end up in the same situation as those trying to live off fixed income. Both categories are being culled from the human gene pool.

The average Merrill employee got $247,423 in compensation and benefits in 2008: avg BofA? $75g's.

Monday, January 26, 2009

Yes we can-can: the Pointless Misters in Washington

Think we can't continue the breathtaking scope of political duplicity and malfeasance epitomized by the Bush Administration? With the appointment of Geithner, Summers, and Rub(it)in, the Obama administration says "Yes we can".

Can we name the man named the #8 crook in America by a MarketWatch poll (that would be Robert Rubin)? "Yes we can".

Can we put in charge of the UStreasURY , and thereby the IRS, a man, Geithner, who "neglected" to pay in taxes more than most of us make in a year? "Yes we Can".

Can we appoint a man as Economic adviser someone who thinks exporting America's manufacturing base overseas so as to save on healthcare costs is economically mandated and encouraged, as Jabba-the-Hutt Summers has opined? "Yes we can".

It's change we can believe in; the bills, we're not so sure about.

No wonder the Republican House minority has a Boehner.

Darling stated, "We have a clear view that British banks are best managed and owned commercially and not by the government. That remains our policy."

That is a mind-boggling admission of failure. Banks managed and owned commercially have brought the global financial system to utter ruin. Debauched, incapacitated and completely at a loss of how to generate capital, they are on a life-support system by a government that insists they're doing a fine job of running themselves (right into the ground, as it turns out).

Can we name the man named the #8 crook in America by a MarketWatch poll (that would be Robert Rubin)? "Yes we can".

Can we put in charge of the UStreasURY , and thereby the IRS, a man, Geithner, who "neglected" to pay in taxes more than most of us make in a year? "Yes we Can".

Can we appoint a man as Economic adviser someone who thinks exporting America's manufacturing base overseas so as to save on healthcare costs is economically mandated and encouraged, as Jabba-the-Hutt Summers has opined? "Yes we can".

It's change we can believe in; the bills, we're not so sure about.

No wonder the Republican House minority has a Boehner.

Darling stated, "We have a clear view that British banks are best managed and owned commercially and not by the government. That remains our policy."

That is a mind-boggling admission of failure. Banks managed and owned commercially have brought the global financial system to utter ruin. Debauched, incapacitated and completely at a loss of how to generate capital, they are on a life-support system by a government that insists they're doing a fine job of running themselves (right into the ground, as it turns out).

Subscribe to:

Posts (Atom)