The goal of the PPIP is not price discovery, but creating an artificial price and

generating fees for the dealer and asset management community. But the big payoff could be for the likes of our friends at PIMCO, Blackrock (NYSE:BLK) and the other asset managers who will be called upon to maintain this bloating superslushfund site.

A more cynical view is that complexity is designed to disguise the fact the PPIP enables Federal agencies to take steps well beyond their mandates.

The tragedy is that the time lost between now and when the President realizes he is getting bad advice from Summers & Geithner could be the difference between a very bad recession and a crippling meltdown that is, in part, made worse by a strategy of coverup that represents virtually no change from previous policy.

Countries without a surplus face the constant temptation to devalue their currency.

While the Tata Nano has received much international publicity, India's other automotive innovation - the Reva-i - has quietly become the world's best-selling electric car, with support from two Northern California firms. The Reva-i is unlikely to dent the global market with as much force as the Tata Nano, industry analysts predict.

At $6,000, the four-seat, Reva-i costs three times more than the Tata Nano and holds only a limited appeal to cash and credit-strapped first-time car buyers. "It is very much a second car in the household," said Maini, who added that nearly 40 percent of cars sold in India are second vehicles...so....still think electric vehicles'll slow Climate Change?

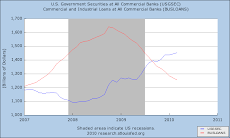

“The primary trend is down,” says Richard Russell. In the end, he continues, no matter what Obama and Bernanke do, the primary trend will have its way. The bear market will continue until it “has fully expressed itself.” “Cash and gold,” says Richard, are the only investments you should be holding now; we’re a long way from the bottom.

“The old Wall Street adage about the dangers of catching a falling knife doesn’t seem to be scaring individual investors away from Citigroup Inc.

Remember, this is a depression, not a recession. And thanks to determined government action, it is on its way to becoming a Great Depression. In a depression, you can’t revive the old economy. It needs structural change — eliminating the mistakes of the previous bubble period(s) — and building new businesses with new ways of doing things. “Creative Destruction” Schumpeter called it. Things that don’t work need to be destroyed (in this case human lives)...so that things (in a capitalist structure, that's all humans are: resources...things...if they can't, or won't, work, they must be destroyed, it's simply a mandate of monetary fundamentalism...nothing personal/judgmental, mind you) that do work can make use of the capital more efficiently.

The big surprise of this depression: it will kill the bulls when the bear market rally collapses...then it will kill the bears when the mining and commodity stocks collapse...and finally, it will wipe out the middle-class savers (finally finishing the job Reagan started) when inflation increases and the dollar collapses.

An SDR is “a synthetic currency created by the IMF, whose value is determined as a weighted average of the dollar, euro, yen and pound”. (And exactly how does a weighted average of collapsing currencies create a reserve currency?)

According to a study published this week by the Center for Retirement Research at Boston College, public pensions will need $270 billion in new contributions over the next four years just to stay afloat, and another $100 billion annually for the 20 years afterward. All during the greatest wave of public retirement in U.S. history.

The 55-and-over unemployment rate is at an all-time post-World War II high, while the percent of the total unemployed who have been out of work for 15 weeks or longer is also at a post-World War II high of 43%...those are the ones that got the lead parachute, the alchemists being too busy working on those gold ones for the management class.

Americans across the board are already falling behind on loans at a record rate. In the last quarter of 2008, a record 4.2% of all consumer loans were delinquent at least 30 days, says data from the Fed this week. Another 4% were in default.

“The wheels have fallen off the economy," James Chessen, chief economist for the American Bankers Association, told USA Today. "There have been significant job losses, and that translates into people having a hard time paying their bills."

Although Subprime mortgages are suffering the highest rate of delinquency, the delinquency growth rate among prime and Alt-As, from the beginning of 2008 to the end, more than doubled. Plus, delinquent prime and Alt-A loans far outnumber subprime, which means we have likely yet to see the worst of the housing bust.

Personal bankruptcies in the U.S. were up 38% in March compared with the same time last year. 130,793 people filed for some form of bankruptcy last month. 1.5 million are expected to go under by the end of the year, a 36% hike from 2008.

Dow is up 21.5% over the last four weeks… its best streak since 1933.

Once this rally’s over, we’re going to return to despair like you’ve never seen,” Dick Rule warned.

Nearly 40 airlines around the world have gone under since the recession began.

The slack economy’s loss of output is running at $1 trillion a year.

Throughout this economic downturn, Canada has remained our largest source of oil. While the Saudis shipped us a little over one million barrels every day in January, Canada sent over 2.5 million bbls/day.

This syndrome - declining employment in the core economy, growing reliance on jobs in marginal enterprises or in an unofficial black-market economy, and rising rates of violent crime leading to increased state repression - is likely to be repeated in a range of other countries suffering from the global economic crisis.

The US is scrambling to get Europe and Asia to inflate their own currencies through massive 'stimulus' spending, in order to hide the simple truth - the US will eventually default on its debt.

Around the turn of the millennium, the cash equivalent of the Dow would buy 650 barrels of oil. Today it'll bring you 150 barrels.

Elimination in 1997 of taxes on residential capital gains up to $500,000. If housing prices more than double in a seven-year period without a commensurate increase in income, eventually something has to give.

Thirty-five companies defaulted in March, the highest number in a single month since the Great Depression, according to Moody’s Investors Service.

Peak oil means no more ability to service debt at all levels, personal, corporate, and government.

Americans borrowed too much, and the bankers who made obscene fortunes in fees and bonuses in fraudulent lending managed to leverage this unpayable debt into the greatest collective swindle the world has ever known. The swindle has sent poison into every cell of the macro socio-economic organism, and further swindles are unlikely to revive it...get it Geithner?

Once the first window is broken, all bets are off for social stability.

We mortgaged our future and the future has now begun.

World industrial production, trade and stock markets are diving faster now than during 1929-30. World trade is falling much faster now than in 1929-30: This is a Depression-sized event.

Wednesday, April 8, 2009

Wednesday, April 1, 2009

News and Views.

Investment and vacation homes accounted for 30% of all purchases of existing and new homes in the United States in 2008, the National Association of Realtors said yesterday (Monday 3/30/09).

What the Treasury needs to worry about is a run on the insurers. Annuity and whole life policies are at risk, and the blogs are starting to buzz about it. If customers rush to cash policies in, a number of insurers will be at serious risk.

Once again: the Treasury is pursuing the phantom of a bank-led economic recovery, when it should be fighting the risk of an insurer-led crash. If Americans think their insurance policies and annuities are at risk, it’s a different and much worse sort of crisis.

Bank protection has gotten very pricy during the past month, despite the Geithner plan. The cost of insuring Citigroup’s 5-year senior debt has jumped from LIBOR +300 bps to LIBOR +600 bps between the end of January and the end of March, while Bank of America has jumped from +200 bps to +400 bps.

As the equity price approaches zero, that is, the obligor’s option to default gets closer to the money, the price of the option (reflected in credit protection) rises vertically. The key driver of credit default swap spreads is the perception that banks either will go up a great deal or go down a great deal. Credit default swaps are an option, and the extreme volatility of bank stocks makes options more valuable. Again, they will either go up a lot or go down a lot. Volatility reconciles widening credit spreads and higher stock prices.

In the relative short term, say, the next two quarters, Citigroup’s profits are whatever the government says they are. Timothy Geithner owns 36% of the bank.

Peak Oil's courageous spokesman, Matt Simmons, claims that production from the world's aging oilfields is dropping by as much as 20% a year.

By the end of 2009, two-thirds of the state's banks will be operating under cease-and-desist orders or other regulatory actions, Anaheim-based banking consultant Gary S. Findley predicts. (LATimes) Regulators are preparing for a major wave of failures.

As IBM was firing thousands of American workers last week, the U.S. Patent and Trademark Office published Big Blue's application to copyright a computerized system that calculates how to offshore jobs while maximizing government tax breaks.

City officials and housing advocates here (So. Bend) and in cities as varied as Buffalo, Kansas City, Mo., and Jacksonville, Fla., say they are seeing an unsettling development: Banks are quietly declining to take possession of properties at the end of the foreclosure process, most often because the cost of the ordeal — from legal fees to maintenance — exceeds the diminishing value of the real estate.

Word from China’s Xinhua News Agency is that China and Argentina have agreed to set up a currency swap worth $10.24 billion. That is, trade between the two countries will henceforth be settled in yuan. China already has similar agreements with South Korea, Malaysia, Indonesia and Belarus.

Half of the U.S. work force is on the payrolls of companies with 500 or fewer employees.

Kunstler: What’s going on now is nature’s way of telling you that America’s standard of living has to be reduced by something between 20 and 50 percent. Banking (capital deployment) is already mortally wounded. It remains to be seen how this will affect the food supply half a year ahead in the harvest system. Capital is as big an “input” for our method of farming as diesel fuel or fertilizers made from methane gas. The failure of banking will combine with city and state insolvency to crush public transit, law enforcement, fire protection, and whatever flimsy local safety nets exist to keep the ultra-poor and helpless from die-off.

It's shocking to me that the consensus among the hotshots of climate and energy science and the elder statespersons of environmentalism is that the energy problem merely amounts to finding other means for running cars. The assumption that we must remain car-dependent remains absolutely entrenched among people who ought to know better. Of course, the words “public transit are barely uttered. It’s disappointing to find such idiocy among this particular elite.

Based on the statistics from the Energy Information Administration, the U.S. pumped out more than 9.6 million barrels of oil per day in 1970. In 2007, production barely averaged over 5 million barrels a day. As you can see, we briefly managed to keep production at a plateau before falling down the backside of the peak.

And if you really want to crunch the numbers, the news is even more grim. In 2008, our production averaged 4.95 million barrels per day. We haven't seen a yearly production average under 5 million barrels since 1946.

Stretching across North Dakota, Montana, South Dakota, and southern Saskatchewan is the Williston Basin,home to the Bakken formation, one of the few areas in the US where oil production is expected to increase.

The fall in the 'core core' CPI underlines that deflation might become an issue in Japan with the output gap opening up massively and the labor market getting weaker. Declining demand at home combined with an inflow of cheaper goods from abroad triggered by recent appreciation of the yen, could drive down prices into the feared deflationary spiral.

March 31 (Bloomberg): The U.S. government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

Deutsche Bank AG Chief Risk Officer Hugo Banziger said the credit crisis is “far from over” and global financial regulations must be overhauled. Banziger said credit spreads are higher than before Lehman Brothers Holdings Inc. collapsed last year, which he said signaled the crisis was far from ending.

What the Treasury needs to worry about is a run on the insurers. Annuity and whole life policies are at risk, and the blogs are starting to buzz about it. If customers rush to cash policies in, a number of insurers will be at serious risk.

Once again: the Treasury is pursuing the phantom of a bank-led economic recovery, when it should be fighting the risk of an insurer-led crash. If Americans think their insurance policies and annuities are at risk, it’s a different and much worse sort of crisis.

Bank protection has gotten very pricy during the past month, despite the Geithner plan. The cost of insuring Citigroup’s 5-year senior debt has jumped from LIBOR +300 bps to LIBOR +600 bps between the end of January and the end of March, while Bank of America has jumped from +200 bps to +400 bps.

As the equity price approaches zero, that is, the obligor’s option to default gets closer to the money, the price of the option (reflected in credit protection) rises vertically. The key driver of credit default swap spreads is the perception that banks either will go up a great deal or go down a great deal. Credit default swaps are an option, and the extreme volatility of bank stocks makes options more valuable. Again, they will either go up a lot or go down a lot. Volatility reconciles widening credit spreads and higher stock prices.

In the relative short term, say, the next two quarters, Citigroup’s profits are whatever the government says they are. Timothy Geithner owns 36% of the bank.

Peak Oil's courageous spokesman, Matt Simmons, claims that production from the world's aging oilfields is dropping by as much as 20% a year.

By the end of 2009, two-thirds of the state's banks will be operating under cease-and-desist orders or other regulatory actions, Anaheim-based banking consultant Gary S. Findley predicts. (LATimes) Regulators are preparing for a major wave of failures.

As IBM was firing thousands of American workers last week, the U.S. Patent and Trademark Office published Big Blue's application to copyright a computerized system that calculates how to offshore jobs while maximizing government tax breaks.

City officials and housing advocates here (So. Bend) and in cities as varied as Buffalo, Kansas City, Mo., and Jacksonville, Fla., say they are seeing an unsettling development: Banks are quietly declining to take possession of properties at the end of the foreclosure process, most often because the cost of the ordeal — from legal fees to maintenance — exceeds the diminishing value of the real estate.

Word from China’s Xinhua News Agency is that China and Argentina have agreed to set up a currency swap worth $10.24 billion. That is, trade between the two countries will henceforth be settled in yuan. China already has similar agreements with South Korea, Malaysia, Indonesia and Belarus.

Half of the U.S. work force is on the payrolls of companies with 500 or fewer employees.

Kunstler: What’s going on now is nature’s way of telling you that America’s standard of living has to be reduced by something between 20 and 50 percent. Banking (capital deployment) is already mortally wounded. It remains to be seen how this will affect the food supply half a year ahead in the harvest system. Capital is as big an “input” for our method of farming as diesel fuel or fertilizers made from methane gas. The failure of banking will combine with city and state insolvency to crush public transit, law enforcement, fire protection, and whatever flimsy local safety nets exist to keep the ultra-poor and helpless from die-off.

It's shocking to me that the consensus among the hotshots of climate and energy science and the elder statespersons of environmentalism is that the energy problem merely amounts to finding other means for running cars. The assumption that we must remain car-dependent remains absolutely entrenched among people who ought to know better. Of course, the words “public transit are barely uttered. It’s disappointing to find such idiocy among this particular elite.

Based on the statistics from the Energy Information Administration, the U.S. pumped out more than 9.6 million barrels of oil per day in 1970. In 2007, production barely averaged over 5 million barrels a day. As you can see, we briefly managed to keep production at a plateau before falling down the backside of the peak.

And if you really want to crunch the numbers, the news is even more grim. In 2008, our production averaged 4.95 million barrels per day. We haven't seen a yearly production average under 5 million barrels since 1946.

Stretching across North Dakota, Montana, South Dakota, and southern Saskatchewan is the Williston Basin,home to the Bakken formation, one of the few areas in the US where oil production is expected to increase.

The fall in the 'core core' CPI underlines that deflation might become an issue in Japan with the output gap opening up massively and the labor market getting weaker. Declining demand at home combined with an inflow of cheaper goods from abroad triggered by recent appreciation of the yen, could drive down prices into the feared deflationary spiral.

March 31 (Bloomberg): The U.S. government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

Deutsche Bank AG Chief Risk Officer Hugo Banziger said the credit crisis is “far from over” and global financial regulations must be overhauled. Banziger said credit spreads are higher than before Lehman Brothers Holdings Inc. collapsed last year, which he said signaled the crisis was far from ending.

Subscribe to:

Posts (Atom)