Roubini: "So all the gold bugs who say gold is going to go to $1,500, $2,000, they’re just speaking nonsense. Without inflation, or without a depression, there’s nowhere for gold to go. Yeah, it can go above $1,000, but it can’t move up 20-30 percent unless we end up in a world of inflation or another depression. I don’t see either of those being likely for the time being. Maybe three or four years from now, yes. But not anytime soon."

Hmmmm ... how a little financial meltdown can change one's whole perspective. With people's 401's and IRA's devastated and no hope of providing even a modicum of retirement income, an investment that in 3-4 years will provide 20-30% gains ( with considerably higher upside potential maintained by other financial advisers .. and don't even mention Jim Sinclair) is considered nonsense. That's exactly what my financial adviser at Fidelity told me 5 years ago. A young man named Chin with a degree and as much financial acumen as a ventriloquist dummy. Because, that's all Fidelity (or Lehman's or Bear's, or, well you get the point) looked for in their HR hiring. Just as in the days of Big Blue, which then meant IBM, no Data Center manager could go wrong buying IBM, even if there was a much better deal to be made buying PCM (plug-Compatible Machine) vendors' equipment, (which meant their equipment was capable of plugging into the IBM channel). Similarly, investment banks' HR looks for a degree, and then safely hires those with the appropriate approved university credentials, even though that credential meant only that the "analyst" knew nothing more than how to parrot the notions fed to him like pablum to an infant.

Had I listened to Fidelity's advise, the recovery of my portfolio, to higher than what it was before the meltdown, could not have happened, and Fidelity's advise to steer clear of gold, recorded for my protection, would have no repercussions for them, only for me: I'd be destitute. They'd still be rich, their analysts retained, as they made money for the firm. That is their job. Making your portfolio perform well for you is not. That should be self-evident in a country proudly proclaiming that greed is all that matters, but somehow it escapes most investors, who quaintly believe investment firms have their customers' interests at heart.

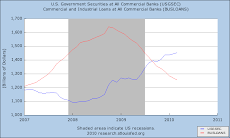

Since I started being interested in gold, around 2002, because the goldbugs were the only financial analysts who weren't buying the Kool-Aid of "New Economy" nonsense, the price of the precious metal has quintupled...not in 2002, nor 2003, nor 2004, n0r 2005, but slowly and steadily, gaining each year, so had I listened to Roubini then:

"Maybe three or four years from now, yes. But not anytime soon."

His words would have been music to my ears. I had no intention of spending my savings for retirement sooner than "2/3 years from now" (well meaning then as "now"), so why should I care what roller coaster ride the Stock Market was going to gyrate through if I could be reasonably assured of 20-30% gains if I simply bought gold? Having had to listen to the exact same garbage spewed by the likes of Cramer throughout the 90's, only to witness friends in my industry (computers and networking, which includes telephony) lose everything, it was truly mind-boggling to me that the charlatans could use the exact same strategy and doublespeak to do it all over again, only on a much grander scale.

If Capitalism had proved its superiority over Communism, then exactly what were we doing developing a "New Economy"? The tacit admission is that Capitalism, without the competitive edge furnished by an alternative to its "Greed is good, and everyone trying to fuck over everyone else will magically make everyone better off" philosophy, is doomed to failure by its own absurd contradictions epitomized by Reagan's mentor, Margaret Thatcher's, denial that society exists, and only the individual matters, even as we send young men off to be killed, demanding they surrender their individual self-interest in the name of society.

So perhaps Roubinin's right and "all the gold bugs who say gold is going to go to $1,500, $2,000, are just speaking nonsense". But everyone's speaking nonsense. And since the turn of the millennium, when the Y2K bug was the nonsense du jour, the nonsense of the gold bugs has been, and continues to be, the most sensible nonsense in what has (predictably) turned out to be not a "Goldilocks" economy, but an "Alice in Wonderland" economy, sustainable only by constant warfare, continuous lies, and infinite economic expansion on a finite globe, all fueled by ever decreasing supplies of dirtier and more expensive fuels, driven by consumers being laid off in record numbers, with those keeping their jobs being paid less and working less hours, thrown out of their homes in unprecedented numbers, no prospects for job creation in either of the worlds' largest economies, being told to increase their savings and pay down their credit cards and making sure they spend more, all simultaneously. Even Lewis Carrol'd have trouble being more nonsensical than those expectations .

Wednesday, October 28, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment