This week, Toll Brothers Inc. CEO Robert Toll said: "Yesterday’s subprime is today’s FHA. It’s a definite train wreck and the flag will go up in the next couple of months: Bail us out. Give us more money.”

Across town, Bernie-anke was saying “Our commitment to our dual objectives, together with the underlying strengths of the U.S. economy, will help ensure that the dollar is strong…”

For those that are unfamiliar with the fact, the Federal Reserve currently has two legislated goals--price stability and full employment- talking up the dollar is in the purview of the Treasury.

Meanwhile Asian governments are threatening (and taking) capital controls as a way of protecting their economies from an invasion of cheap US dollars via the 'carry trade'.

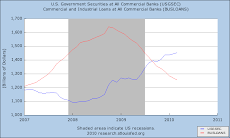

US Fed - Benron Bernie-anke's - policies have driven short-term interest rates to zero and below. This creates free money for the banks, permits a massive carry-trade of speculation against the dollar and puts pressure on "investors" to abandon the safety of Treasuries and chase riskier assets higher. This is not an accident, it is a policy goal... one that's completely at odds with "ensuring that the Dollar is strong".

With no economy to sustain it, the dollar is buoyed solely by its reserve status and the international assumption that it is a safe-haven investment in times of financial turmoil: what Doug Noland refers to as "Monetary Disorder". So what does Bernie-anke know that we don't? The only way the dollar will strengthen is if some global calamity struck.

The most likely and most helpful, would be an air-strike by Israel on Iran. This would accomplish at least 2 goals of Bernie-anke's, neither of which is the legislated one, but having failed miserably at stabilizing inflation it then saddled the economy not only with huge unemployment numbers, but also the liabilities it took on from the banksters. So now the Fed must mask its utter incompetence and take on strengthening of the dollar as its new mandate. Of course, we already know how well this is going to turn out.

But masking problems is what we like to see done, so that is why an attack on Iran is so advantageous. By causing a massive oil panic, it'll mask the real underlying reality of peak oil production having been reached some time late in 2005. With the oil disruption caused by Israel's action, the instability in the market will be ascribed to whatever actions the Iranians will take in retaliation .. done, no more talk of peak oil. When its realities finally come to the surface, Bernie'll either be gone or can just pull out from his stock-phrase portfolio, the perennial favorite, "Nobody could've seen it coming...".

And since the dollar's still seen as a safe haven in times of international turmoil, it'll strengthen against all asset classes, including gold. After all, who cares how much gold you horde if you ain't got the ICBM's to keep US predators from blowing it up?

And with a stronger dollar, oil will get more expensive for the rest of the world and cheaper for US, even if its price doesn't nominally change... which of course, means inflation will go up in the US, but that's the point, that's what Bernie made-off-with the-Fed wants, higher inflation, to get those home prices even more out of reach, so the Treasury's $8k bait gaffes even more foolish fish, 'cause without it, no one's buying the Kool-aid.

So then, what is the Fed's new mandate? Since it's actually ignoring its legal requirements, it can't really be called a mandate, so more its assumption then. Well, since it now working hand-in-glove with the Treasury, its #1 task is the skewering of the dollar, while talking it up, to keep the value of dollar debt held by China, the Gulf States, and Russia deteriorating, and #2, to keep interest rates low, facilitating the burgeoning deficits, national debt and the $ carry trade (which keeps demand for dollars artificially high, a la Japan's carry trade in yen of a mere 2 years ago). This will ensure the collapse in bubbles being blown all over the world. That's when the Fed can contemplate interest rate increases again, as the social unrest...well riots... and destruction of American-owned property on a scale not envisioned by its Masters, I mean Owners, will panic Americorpse into actually investing in American labor, which is much more stupefied, malleable, and just more inert in general, making it much less likely to destroy capital's investments in productive capacity.

The resultant collapse in demand for oil from the two developing economies of India and China will result in the masking of peak oil long enough for the blame to go the next administration, and for the inevitable blow-back (that nobody could've seen coming...") to be blamed on how the world hates our Friedom, as we wheel out the revenge machines for some more hard-earned retribution on infidels, with Palin screaming at the Military: "Drill, Baby, DRILL!

Saturday, November 21, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment