Worldwatch Institute's president, Christopher Flavin, as quoted in an article in the Guardian, entitled "US cult of greed is now a global environmental threat", writes: "As the world struggles to recover from the most serious global economic crisis since the Great Depression, we have an unprecedented opportunity to turn away from consumerism. In the end, the human instinct for survival must triumph over the urge to consume at any cost."

First of all, it is only NOW an environmental threat? Helloooo!

But mostly, his, one can only assume, cynical, statement, that we have an unprecedented "opportunity to turn away from consumerism", is hilarious. Every step taken on every continent on the globe, has spurred the productive capacity of the underlying private enterprise infrastructure to force the hand of every human on the planet to greater and greater consumption. What does Mr. Flavin think "government stimulus" is meant to stimulate? Intellectual discourse? Art appreciation? Love of nature, or love of books or love of the study of the wonderful variety of creatures that co-inhabit our globe? These are all faggie, commie, pinko, pursuits long derided and severely punished by social isolation and ridicule by the great consumer machine called the USA.

Upon visiting the Phillipines, the investor adviser Tony Sagami, of Uncommon wisdom, raved, "The 12th most populous country in the world is dotted with skyscrapers, BMWs, Starbucks, construction cranes, and luxury stores." If this is how success is measured by someone from the Empire, that's how Everyone, especially poor Pillipinos, are going to measure it.

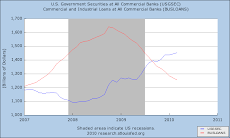

“China’s retail sales grew at the fastest pace in more than two decades in 2009 as government stimulus spurred demand for home appliances, cars and electronics in the world’s most populous nation."

NO demand increase for books, art supplies, hobby and crafts paraphernalia. The entire push of the stimulus from governments everywhere are for energy-intensive manufactures, not only in the production of the products themselves, but energy intensive in their use. Big-screen TV's eg, often use at least 4X's the power of the ones they're replacing. Utter passivity and nonchalant laziness are signs of prosperity and success, while actually working is seen as an indication of failure and stupidity (who but poor, stupid Mexicans would actually go out and work in fields sowing, tending and picking food?).

As the British elderly start buying encyclopedias, to keep warm by burning them instead of logs in their fireplaces (another increasing source of sequestered CO2 being released to the atmosphere), it's totally ignored that the "there is no such thing as Society" attitude of the Reagan-Thatcher Mafia of plundering the resources of ones country as a right, using taxpayer dollars for exploration, then shuttling all the profits to a smaller and smaller "entrepreneurial" elite of criminals, just fell to the ground with a resounding crash.

Thus has the North Sea been left with dwindling oil reserves now that the price of that resource fetches north of $80/bbl. But it was sold off, the new supply having flooded the market thereby dropping the price to $10/bbl, where it was when GW Bush took office, leaving Great Britain scrambling for resources and capital now, a mere generation after having tapped a bonanza in its own backyard.

Any attempts to slow the extraction of the North Sea oil would have been/were crushed. We couldn't be left dependent on a bunch of sheiks. No. How much more intelligent to sell off at a discount the entire legacy so as to enrich the aristocracy and then leave the rest of the non-entities, for if there's no such thing as society, that's all we are, to be dependent on that same bunch of sheiks, whose reserves would now have been that much smaller, and the UK's that much larger.

The effect has been to allow, per Max Keiser (“Goldman Sachs Are Scum” | zero hedge.) :“They are literally stealing a hundred million dollars a day. Goldman Sachs is stealing every day on the floor of the exchange. They should be in the Hague, they should be taken on financial terrorism charges. They should all be thrown in jail”. (http://www.smirkingchimp.com/author/matt_taibbi)

He declares during his jeremiad that the crash on Wall St has caused, continues to cause, more collateral damage than the attacks on the WTC and Pentagon.

In other words, what Keiser is saying, that no "patriotic" American wants to hear, is that the attack gave the US denizens a chance to see exactly what was being done to them and by whom. Instead, they watched, no cheered, as the very enablers of the attacks literally wrapped an enormous flag around themselves and the NYSE. As patriotism is the last refuge of the scoundrel, Wall St. brazenly announced their true nature, and all were blind to it.

"Yes, we're scoundrels, but we're YOUR scoundrels," that flag screamed, as they feverishly set out to step up, aided and abetted by their lapdogs at the Fed, their War against the Dollar and the American people. Because, yes, that was the third target of the terrorists on that sparkling day in September. The third undemocratic institution they targeted was the FED, not the Congress or Whitehouse, which at least keep up the facade of democracy. But Wall St, the Pentagon, and the Fed are completely unanswerable entities, with their own cultures, all sharing only one thing: complete disdain and contempt for the masses they purport to serve. All three of these completely undemocratic institutions serve only the Superclass. And given their position on top of the power pyramid, that means, so do we.

So as Max Keiser shouts that Goldman Sachs steals every day, his words'll fall on deaf ears, and the response from GS'll be a nonchalant Cheney-esque shrug of their shoulders ("So?"), as they ask, "Well, what did you think we were doing? That's what Capitalism is you fools."

And, no, Mr. Flavin, the human instinct for survival will NOT triumph over the urge to consume at any cost, because the power to change that is not in our hands. It is in the hands of the Superclass ( David

Rothkopf's "

Superclass: The Global Power Elite and the World They Are Making") that'll be meeting soon in Davos again, to celebrate another year of their ascendancy over the rest of the cowering, blighted, mass of humanity whose ability to do anything else

but consume has been all but destroyed.

The twin tower of government deficits and massive misallocation of private capital will continue to dwarf any attempt to change them until environmental degradation and resource constraint brings them crashing down on our heads, while the Superclass sips their martinis and shuts the gates of their tax-payer-funded guarded compounds until the dust settles and they venture out for their next bout of pillaging.