“The Federal Reserve did not do all that it could have (ie did NOTHING) to constrain excessive risk-taking in the financial sector in the period leading up to the crisis,”

"U.S. house prices have risen by nearly 25 percent over the past two years," noted Bernanke, while chairman of the president's Council of Economic Advisers, in testimony to Congress's Joint Economic Committee. But these increases, he said, "largely reflect strong economic fundamentals," such as strong growth in jobs (there was in fact, no growth in jobs), incomes (ditto - no growth, all the growth in the economy was coming from people taking out HELOCs to draw the "ghost equity" out of their homes, much like borrowing on margin as the value of the stock market rises, and a strategy highly recommended by the Fed who, of course, knew the extreme risk involved in transferring that strategy to an asset such as property which is much harder to sell into a deflating market, hence the cheer-leading of the Goldilocks Economy where house prices never go down) and the number of new households (another figure bloated by ever more people being encouraged to take out loans to become members of "The Ownership Society").

So even as Benron decries Congressional oversight for the oligarchy known as the Fed:

Ben S. Bernanke does not think the national housing boom is a bubble that is about to burst, he indicated to Congress last week, just a few days before President Bush nominated him to become the next chairman of the Federal Reserve.

Federal Reserve Chairman Ben Bernanke said Thursday that there will be "significant losses" associated with subprime mortgages but that these losses should be regarded as "bumps" along the road of market innovation.... AhHAHhAHAHA. Let's read Galbraith: "All financial innovation involves, in one from or another, the creation of debt secured in greater or lesser (do you think we could say 'subprime' would mean lesser?) adequacy by real assets."

"The DiceThrow": "Banking organizations of all sizes have made substantial strides over the past two decades in their ability to measure and manage risks.”

Benron: “By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also REDUCE THE VALUE OF A DOLLAR in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services.”

Let's ask Galbraith again: "When banks (in this case, Fed Chairman, "The DiceThrow", Bernanke) discovered that they (He) could print bank notes and issue them to borrowers in a volume in excess of the deposits in the banks' vaults, there was no seeming limit to the debt that could be leveraged on a given volume of hard cash. A wonderful thing." Yet we think we're in a position to call China a currency manipulator?

Ben "The Dice-Throw" Bernanke told lawmakers Tuesday he expects the downtrodden U.S. housing sector to improve by the end of the year,

"We will continue to formulate policy to guard against risks to our dual mandate to foster both maximum employment and price stability.” Continue? When did the Fed, during "The Dice-Throw"'s tenure, do either?

"The civilian unemployment rate is expected to finish both 2007 and 2008 around four-and-a-half to four-and-three-quarters percent."

Feb '08:

"I expect there will be some failures” of smaller banks. “Among the largest banks, the capital ratios remain good and I don't anticipate any serious problems of that sort among the large, internationally active banks that make up a very substantial part of our banking system."

"Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost."

"Many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade, though this would not have been the case, of course, had interest rates trended sharply upward" ... the Fed shortly thereafter started their "baby-step" interest rate increases to as high as 5 1/2%, intending, per "The Dice-Throw"'s statement in defense of his idiocy, to raise them, as the "Taylor rule" suggests, to 7 or 8% before stopping.

As the master of “activist” monetary management, Mr. "The Maestro" Greenspan’s reign at the helm of Fed oversaw a move into uncharted territory with respect to marketplace interventions and manipulations. What was the instrument of this manipulation? Interest rate policy, the only lever available to the Fed that Benron now denies has any effect.

"A particularly important protective factor in the current environment is the strength of our financial system…our banking system remains healthy and well-regulated,…"

"I have no particular regrets. The housing bubble is not a reflection of what we did, as it is a global phenomenon."

Alan "The Maestro" Greenspan, November 23, 2007

“I was not going to be the Federal Reserve chairman who presided over the second Great Depression,” Ben Bernanke told PBS .... note that's in the past tense.

"It wasn't to help the big firms that we intervened," argued Mr. "The Dice-Throw" Bernanke as he discussed intervening to help the big firms.

This would be funny if it weren't so dire. But let's look at the irony instead. The Fed has a dual mandate: full-employment and keep inflation from destroying the monetary system. It long ago gave up on full employment, as it is inflationary, and it is now actively working, by its own admission as justification of its 0% Fed funds rate, to create inflation. In other words, there is no need for the Fed, by its own logic it should be abolished. But as Galbraith says, "Those who are involved never wish to attribute stupidity to themselves."

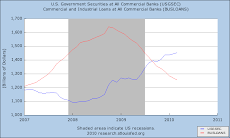

Let's get it straight, since we're stuck with idiots in high places. When the Fed keeps interest rates at 1%, while inflation rate is even a modest 4%, that's a negative 3% on savings accounts. Meanwhile, that same policy that keeps savings accounts paying Real negative rates, pushes nominal housing appreciation up by 25% in 2 years. What that does is force people to take risk they otherwise would not, as it makes saving money for your retirement absolutely hopeless. Every dollar you save starts losing its value immediately. The only way to have any growth is to take those savings and plow them into an asset that appreciates over and above the inflation rate. Because, as Einstein said, “The most powerful force in the universe is compound interest”, but he forgot to mention that the most powerful countervailing force in the universe is compound inflation, that sucks the value of your money toward zero by the time you go to spend it (as we'll all see in the not too distant future).

"The Dice-Throw" Bernanke is a liar. If interest rates had nothing to do with the housing bubble then, then they have nothing to do with housing prices now, and so they should be raised. What do you think the odds of that happening are? The banks should be required to pay an interest rate to their depositors of at least what the Fed's paying them to park their reserves. If this a "free market" economy, can you please tell me where I can put my savings outside of the banking system, besides under my mattress? Why is there no competition for the most fundamental of needs: a safe haven for one's savings? Instead we are left with "The Dice-Throw" economy lorded over by a liar and a fool whose sole intent is to force savers to take their money out of bank accounts and place them into the Casino known as the wailing Wall St. Wall St. then takes those funds and does, guess what? Invests in the regions of the world that they know are experiencing stronger economic growth than the U.S.:

46.0% South Korea

53.4% Thailand

57.9% Vietnam

58.3% Singapore

74.2% Taiwan

74.3% China

76.3% India

No comments:

Post a Comment