Jonathan Rhys Meyer's character in Woody Allen's "Match Point" starkly illustrates one of the writer/director's own quips: "...His lack of education is more than compensated for by his keenly developed moral bankruptcy". A phrase that, not coincidentally as it turns out, is also a spot-on description of Clyde Griffiths, the sad, rather pathetic protagonist in Theodore Dreiser's novel of murky emotions and desperate greed, "An American Tragedy".

Although Wikipedia says the movie "borrows heavily" from Dreiser's novel, the more accurate phrase would be, "unabashedly lifts" the entire plot and, via some adept manipulations, modernizes it and makes it adaptable to Mr. Allen's medium of choice.

In Dreiser's novel, Clyde Griffiths is not only related to someone in the higher echelons of society, he even closely resembles his cousin, making his initial employment as a drudge unacceptable to his uncle who encouraged him in his move from Chicago to upper state New York, and employs him, as well as his own son, in his Company. That leads to Clyde's promotion to floor manager, overseeing a workforce composed almost exclusively of women, the rule being, one must not fraternize with the lovely ladies over whom you preside.

Naturally one of the delectables proves irresistible to Griffith's lonely romantic yearnings. And Rhys-Meyers is a perfect Clyde Griffiths, only Allen puts the forbidden fruit out of reach by casting her as the fiancee of his future brother-in-law. From there it's by now almost stock:

The seduction, the pregnancy, the insistence on the part of the woman to have his illegitimate baby, the phone calls, the threatened exposure, the murder, which, as commented on by the police, appeared so haphazardly planned as to make it seem like he wanted to get caught, the police's discovery of a diary kept by the murder victim of which the murderer was ignorant, the confrontation with the authorities, the investigator's confidence that our erstwhile hero is in fact our killer.

But this is not to criticize or harangue Mr. Allen for his uncredited lifting of Dreiser's character and plot, but more to marvel at his directorial handling of Jonathan. For we are confronted here not with the same person who appears in "The Children of Huang Shi", but instead with the word made flesh, as Dreiser's Clyde Griffiths appears, as if produced by alchemy, in the cool, bland exterior of Rhys-Meyers, hiding an amoral, materialist, impassioned pretender to wealth who sees nothing in the upper class personality that makes them any more deserving than himself of all the riches and luxuries they take for granted, but which will always, unless he connives to make it so, remain out of his purview.

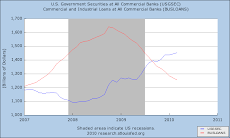

No. For me, what caught my eye and made for a strange (stretched?) analogy, was the similarity between Mr. Allen's reaching back into the past for a vehicle on which to ride into the future. The reason I say stretched, is because it made me wonder if there wasn't an analogy there of the current Fed. By placing an "expert", in the form of Bernanke, at its head who was a student of the Great Depression, and who fancied himself capable of steering the economy as though it were a car, it was fancied he could orchestrate an economic crash, (blandly referred to as "demand destruction", in economists' parlance), in order to slow global growth (and therefore escalating oil consumption), but one from which we could emerge badly shaken, but not severely injured.

But why would he want to do that?

For that we must not only believe the DOE and United States military's Joint Forces Command's projections of future oil production, and its inability to meet projected oil demand, but also realize the utter dependency of the globalized industrial economy, not only on cheap energy, but on that cheap energy coming, in large part, from petroleum and its byproducts.

This was an alarm that was sounded by none other than Dick Cheney in the late 90's, yet not mentioned once during his 8-year tenure in the Bush White House. Because then, before it came to light that the reserves expected in the Caspian basin simply were not there in anywhere near the quantities that had been rosily predicted, Cheney believed peak oil production was something that was in a faraway future.

But by the turn of the century all that had changed. To those, such as Cheney, who had an insider's knowledge that Peak Production was rapidly approaching, it was/is tantamount that the public know nothing about it. Because if peak oil production's imminence were known to the public, it would have the same profound effect on their knowledge of the crimes of the Bush Administration, the Financial industry, and the rest of the Superclass, as the Police's discovery of the murdered woman's Diary in both "The American Tragedy" and Allen's "Match Point".

Namely it would lay bare the fact that, just as in the financial industry, where risk has been surreptitiously collectivized, and profits privatized, the risks associated with the onset of peak oil have been SUV'd onto a hoodwinked public that believes the black gold 'll flow forever, encouraging them to take on more and more debt, believing in a glorious future that will pay for it, and keeping the bank accounts of the Superclass expanding, when all along, that smug band of Oligarchs is fully aware that the party's nearing its climax and the oil-filled punch bowl's about to be taken away, leaving the hoi polloi holding a bag of empty promises and unpayable debt.

So unlike Dreiser's American Tragedy, which concludes with the long trial and execution of the murderer, Woody Allen's ending has him getting off scot-free, with someone else taking the blame for his crime. That is how the denouement of our own American Tragedy will end, with those believing that the oil would flow forever, being blamed, like those who took out subprime loans, for their own credulity, and those who blatantly lied to their face not only flaunting their riches, but, just as Wall St is doing now, patronizingly sneering at the rest of us for being stupid enough to let them. Match point and SET.

Wednesday, April 28, 2010

Wednesday, April 21, 2010

The Financier: Goldman Sacks and Pillages.

|

| The Finance Seers predict we lose. |

In an article entitled, "A Backlash in Europe Has Politicians Calling for a Goldman Ban", the WSJ writes that Goldman Sacks (and Pillages), "is in danger of losing business with a key group of clients as a result of the fraud allegations it faces: governments in Europe and the U.S."

Reading that reminded me of something:

In Theodore Dreiser's epic tome The Financier, he tells the story of Frank Cowperwood, a not-quite rags-to-riches saga of a banker's son who deciphers the financial subtleties of Philadelphia's City Treasury in such a way as to work its mechanism to provide him, and those in government who aid and abet him, with a substantial fortune, lifting them out of a humdrum, and for some, marginal, existence, into undreamed of luxury (well, not quite undreamed of).

Dreiser explains how the city of Philadelphia allowed the Treasurer to lend quite freely from the City coffers to certain brokers and dealers that sold the City's debt, and how our hero, Cowperwood, by manipulating the market on 'change, was able to get the City's debt to sell at par, whereas before his manipulation, it could be brokered for 80%, at most. This legerdemain left the Treasurer breathless and quite agog at the Wunderkind he'd unearthed. And because the Treasurer was allowed to make loans at no interest, since, for some reason, the city allowed those banks it used as depositories to return any amount allocated without paying interest on it, the better Frank Cowperwood could leverage the amounts loaned to him, the more money he could make, and instead of paying the City the interest, he could pay the Treasurer, say, 2%, and everybody's happy with no one the wiser.

So for years Cowperwood ransacked the Treasury's funds, buying up streetcar lines, setting up dummy corporations and using wealth to create more wealth, not of course, for the Commonwealth, even though it was in fact the source of his success, but always as it ever is, to pad his own pocket and those he knew in government who were allowing his defalcations to occur.

He became more and more extended, using larger and larger loans to buy up more and more of the public's property for his own use, using the very same public's funds, until one day in 1871 the City of Chicago caught on fire, and the entire financial district was transformed overnight into a smoldering pile of ash.

Now up to this point Cowperwood's ascendancy did not go unnoticed amongst the city's denizens, but, "all of the newspapers were so closely identified with the political and financial powers of The City, they did not dare to come out openly and say what they thought. It would not be good for Philadelphia, for local business, etc, if they were to make a row. The fair name of The City would be smirched. It was the same old story."

Because the devastation in Chicago was so complete, it resulted in a concatenating failure of insurance companies reaching as far as Philadelphia and exposing the huge risks sloughed onto the public by the profit-hungry banks and brokers ... it was a time, "when all the little rats and mice were scurrying for cover because of the presence of the great, fiery-eyed public cat somewhere in the dark, and only the older and wiser rats were able to act."

However, while the Treasurer's face "was grayish-white, his lips blue", Cowperwood never lost his head; that "thing called conscience, which obsesses and rides some people to destruction did not trouble him at all. Good and Evil? Those were toys of clerics, by which they made money ... Something - he could not say what - it was the only metaphysics he bothered about - was doing something for him" (as he went about doing God's work?).

Yes, in the parallel that's evident here, the citizen is now, thanks to our illustrious Supreme Court that bestows on an amoral fictitious entity the same rights but none of the responsibilities of a person, Goldman. The Goldman's that is indeed culpable of all the same crimes as Cowperwood, but will pay none of the penalties - you cannot send a Corporation to jail, which is where Frank Cowperwood ends up, as does the Treasurer, both of whom are thrown under the bus by the true reigning financial powers of the City, who walk away unscathed.

Before he passes sentence on our feckless duo, the judge addresses the Treasurer thus:

"The misapplication of public moneys has become the great crime of the age. If not promptly and firmly checked, it will ultimately destroy our institutions. When a republic becomes honeycombed with corruption its vitality is gone. It must crumble upon the first pressure.

"In my opinion, the public is much to blame for your offense and others of a similar character. Heretofore, official fraud has been regarded with too much indifference. What we need is a state of public opinion which would make the improper use of public money a thing to be execrated. It was the lack of this which made your offense possible.

"The people had confided in you the care of their money ... a high and sacred trust. You should have guarded the door of the treasury against everyone who approached it improperly. Your position as the representative of a great community warranted that."

Hopefully you've noticed that those words, although in much need of today, are not being, and will not be, uttered. Instead, the head of the Central Bank is running the Fed's balance sheet the same way that Citi and other TBTF institutions ran their books: like a SIV, and doing so aided and abetted by the very Treasury that's disregarded its "high and sacred trust", and has, instead of "guarding the door against everyone who approached it improperly", has flung it open to be ransacked by fraudsters and embezzlers.

And, now that the WSJ, which was one "of the papers that were so closely identified with the political and financial powers of the Citi that they did not dare (care) to come out openly and say what they thought (knew), for years after the malfeasance that they trumpeted as American Exceptionalism so loudly during the boom, comes out to throw Cowperwood, oops, I mean Goldman's, under the train to hide their own and government's and OUR involvement in this confederacy of dunces' dance that even the Citi's Prince couldn't sit down from until the FED stopped playing the music. (At which point they did chuck Prince, but only after awarding him more than $40 million from money amassed by systematically defrauding the entire globe).

| ||||

| Rich man poor man, the Prince and the pauper, One's hired by Goldman, the other, evicted by a Copper. |

Yes the FED. Because, without the backing of gold, it is only the full faith and credit of the Sovereign state of the US Government that backs our dollar. Banks are no longer the independent financial institutions that we all like to keep on pretending that they are: they are mere vassals of the Fed, GSE's completely lacking in resources until the Fed waves its magic wand and creates them. This while they promulgate dogma advocating "free markets" and idol-worshiping "entrepreneurship", as they work to undermine both.

City and government officials on all levels were completely enmeshed in the financial legerdemain taking place. "The Financier" should be required reading in every high school in America. Instead we have them reading "The Great Gatsby" and "Grapes of Wrath", illustrating the perpetrators and the victims, leaving our students without a clue of the methods used by the Gatsbys of the world against the Joads. These methods are brilliantly and clearly set out in Dreiser's book, which, if read, would prevent the Superclass from using the same old tricks with no one the wiser, except the Chairman of the Fed who instead can stand in front of the citizens and claim he never saw the largest financial disaster of the century speeding down the tracks, coming straight at him with both the visibility and the inevitability of a locomotive, at both him and the people it was his bailiwick to protect.

He still got re-appointed.

While everyone's playing "Monopoly", Benron Bernankie knows that the real action is the game of "Risk", namely, how to hide it so you can dupe others into taking it on unbeknown to themselves: it used to be called fraud, now it's called "financial innovation".

And by perpetrating it the agents of the federal government, agents to whom we pay generous salaries and benefits, unavailable to those toiling in the private sector who pay their generous wages, supposedly in order to keep temptation at bay, have squandered the trust of the world (but not ours: Bernanke, Summers, Geithner, Rubin ... they are all still in power) and you will reap the whirlwind because of their treachery, while they, as with the Goldman case, will use sleight of hand to slough the blame onto their agent, that, as in Greece, merely did their bidding, making the Goldman all the richer and us that much poorer.

Tuesday, April 20, 2010

Atlas Mugged: Playn'd Brand of EconTerrorism.

In an article posted on Yves Smith's (author of "Econned") blog, "Naked Capitlism", written by Marshall Auerback, entitled: "Troubles in the Eurozone - Will the contagion affect the US?", he states that, "The President should be using his position of influence, and his considerable powers of oratory, to change public perceptions and explain why these deficits are not only necessary, but highly desirable in terms of sustaining a full employment economy."

Oh please. There is no such thing as a "full employment economy", and if there were, the Fed (and consequently Central Banks all over the globe, specifically, the ECB) has been actively promoting a monetary policy completely at odds with full employment, a policy it cogently refers to as anti-inflationary.

So what Mr. Auerback is suggesting is that the President should jettison any scruples he has and simply come out full-bore with complete lies.

What the financial crisis and its relatively benign effects on the Asian economies should be teaching the West is that industrial mass-production is now completely at odds with industrial mass employment and engenders suppressed wages via cross-border wage-arbitrage. Both India and China have huge reservoirs, (as measured in hundreds of millions) of forced-labor, poverty-stricken, homeless waifs working 12-hour days and mired in interminable hopeless poverty and life-crushing endless toil, that serve as human energy reserves. This is the New Economy the Neo-Liberal regime has fostered and - behind closed doors, as they face the specter of peak-oil production - embraces.

Public and private debt sustainability has exploded as a serious issue in advanced economies, most notably in the eurozone’s countries of Portugal, Italy, Ireland, Greece and Spain—but also in many larger OECD economies, including the U.S. and Japan. These issues stem primarily from a loss of competitiveness, high wage growth and labor costs which outstrip productivity, a nefarious Banker cabal, and undisciplined (to put it kindly) fiscal policies. All of which grew to staggering, unsustainable excesses during the very years the US was attacking sovereign nations in order to bring them our Friedmans (Milton, Thomas and George).

As we celebrate the 40'th anniversary of Earth Day, we should look at the sobering consequences of forcing a Capitalist society to pay for the externalities of their industries' behavior: it drives those industries off-shore where they can influence central governments better. It is no coincident that it was Nixon that "opened the door to China" the same year he instituted the first Earth Day. A dictatorship beholden to the Capitalists for its economic growth, and therefore preferring to shoot its citizens down in full view of the world to letting them think they have the least iota of voice in what "their" government does is much more in keeping with Freidman-ite economic planning than any so-called Democracy does.

So by using workers' pension savings to relocate industrial production to economies that use the power of their totalitarian regimes to suppress wages, ignore environmental degradation and their attendant costs, and consider health burdens to a coughing, asthmatic population to be the burden of the workers, we've shown that a blighted life-expectancy is more desirable than years of no-growth agricultural hard toil and poverty. The way we've seen the Atlas Mugged by Globalization is in no way accidental.

So it should be abundantly clear, from the actions of the Fed and by the Health Industry debates, that the radical Capitalism advocated by the Friedman School of economics that has driven the West for the last generation has no room in it for housing, Health-care coverage, nor education for a middle-class society. All the dynamics of the so-called innovative Neo-liberal regime are toward ensconcing a self-appointed elite class over the rest of society whilst draining the output of Labor into their own off-shore, tax-sheltered bank accounts. So that contagion he speaks of, it should be quite clear, has already occurred; but it went the other way around.

This is what Mr Auerback believes the President should indenture our children to preserving by "using his position of influence, and his considerable powers of oratory". With such claptrap is the road to war paved.

Oh please. There is no such thing as a "full employment economy", and if there were, the Fed (and consequently Central Banks all over the globe, specifically, the ECB) has been actively promoting a monetary policy completely at odds with full employment, a policy it cogently refers to as anti-inflationary.

So what Mr. Auerback is suggesting is that the President should jettison any scruples he has and simply come out full-bore with complete lies.

What the financial crisis and its relatively benign effects on the Asian economies should be teaching the West is that industrial mass-production is now completely at odds with industrial mass employment and engenders suppressed wages via cross-border wage-arbitrage. Both India and China have huge reservoirs, (as measured in hundreds of millions) of forced-labor, poverty-stricken, homeless waifs working 12-hour days and mired in interminable hopeless poverty and life-crushing endless toil, that serve as human energy reserves. This is the New Economy the Neo-Liberal regime has fostered and - behind closed doors, as they face the specter of peak-oil production - embraces.

Public and private debt sustainability has exploded as a serious issue in advanced economies, most notably in the eurozone’s countries of Portugal, Italy, Ireland, Greece and Spain—but also in many larger OECD economies, including the U.S. and Japan. These issues stem primarily from a loss of competitiveness, high wage growth and labor costs which outstrip productivity, a nefarious Banker cabal, and undisciplined (to put it kindly) fiscal policies. All of which grew to staggering, unsustainable excesses during the very years the US was attacking sovereign nations in order to bring them our Friedmans (Milton, Thomas and George).

As we celebrate the 40'th anniversary of Earth Day, we should look at the sobering consequences of forcing a Capitalist society to pay for the externalities of their industries' behavior: it drives those industries off-shore where they can influence central governments better. It is no coincident that it was Nixon that "opened the door to China" the same year he instituted the first Earth Day. A dictatorship beholden to the Capitalists for its economic growth, and therefore preferring to shoot its citizens down in full view of the world to letting them think they have the least iota of voice in what "their" government does is much more in keeping with Freidman-ite economic planning than any so-called Democracy does.

So by using workers' pension savings to relocate industrial production to economies that use the power of their totalitarian regimes to suppress wages, ignore environmental degradation and their attendant costs, and consider health burdens to a coughing, asthmatic population to be the burden of the workers, we've shown that a blighted life-expectancy is more desirable than years of no-growth agricultural hard toil and poverty. The way we've seen the Atlas Mugged by Globalization is in no way accidental.

So it should be abundantly clear, from the actions of the Fed and by the Health Industry debates, that the radical Capitalism advocated by the Friedman School of economics that has driven the West for the last generation has no room in it for housing, Health-care coverage, nor education for a middle-class society. All the dynamics of the so-called innovative Neo-liberal regime are toward ensconcing a self-appointed elite class over the rest of society whilst draining the output of Labor into their own off-shore, tax-sheltered bank accounts. So that contagion he speaks of, it should be quite clear, has already occurred; but it went the other way around.

This is what Mr Auerback believes the President should indenture our children to preserving by "using his position of influence, and his considerable powers of oratory". With such claptrap is the road to war paved.

Subscribe to:

Posts (Atom)