Tuesday, August 21, 2012

The Bucks Won't Clear.

"Sometimes... money costs too much." IRA

(Reuters) - The crew of an Air France plane that was re-routed via Damascus on Wednesday asked passengers how much cash they could stump up after Syrian authorities refused credit card payment to refuel the aircraft, the French airline said on Thursday.

And why shouldn't they? Given the treatment of Iran that's been brought to the forefront by the Standard Chartered's Iranian deals the last few weeks, would you trust that your payment, even should Air France honor their bill, get processed before similar economic sanctions are imposed on Syria's government? With France arming the rebels against the Regime, they're lucky they didn't just shoot them down. Of course, that would be considered an act of War, whereby supplying arms to the "freedom fighters" whose numbers have been reported to include both Taliban and al-Qaeda, is merely pro-democracy.

Which brings to my mind the question of what is Cash? My bank's statement each month tells me how much I have in checking accounts, my financial statements say how much are in money market mutual funds, and they always refer to it as "cash". But is it? As the passengers on Air France learned, it's not. Cash is only what you have in the form of paper money. As the impetus for changing all transaction into electronic blips subject to the whims of a small cartel, it becomes clear that what is meant by cash, and its relation to money, is quickly changing right under our feet, like the sculptures at Sand World. We have built a beautifully intricate structure of perplexing complexity. But by using impaired collateral as the foundation upon which these sand dollars are dependent, should the winds of change blow ever so slightly, the dunes bury all.

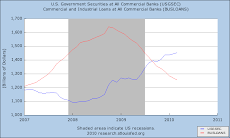

As long as there was some relationship between the productive capacity of the economy and the dollars held by its banking system the value of money, and its interchangeability with cash, was fairly well insured. But that relationship has been systematically eroded. Changing the gold standard to one of exchange rates based on the reserve currency of the dollar, and structuring the purchase of oil such that it must be purchased with dollars changes the entire dynamic of the interchange of wealth.

Although used for centuries as currency, gold and silver were'nt of the same value not simply because gold had more luster, but also because it wasn't used as much as a commodity, whereas silver, like oil, was/is. And although oil has value only when it's burned, gold's is intrinsic, hence its disdainful moniker as a "barbaric relic". But Jairam Ramesh's coining of the term Chindia demonstrates that more than 2 billion of the world's citizens hold gold as a substance worth owning and amassing for its value, not only for its beauty, but as portable, exchangeable, wealth.

Currently here, in the US, a commercial exhorting citizens to trade in their gold for cash sponsors an enthusiastic customer gushing: "I got $1500 for my junk jewelry". But anything that not only stores value, but increases its value over time, is anything but junk. It, unlike the housing base, the productive capacity of the economy, or the extractable resource of oil, all of whose value has diminished dramatically over time, specifically, since the turn of the century when gold was valued at $275/oz, and has soared to more than $1650/oz, reflects a dramatically changing dynamic that Central Banks the world over have pretended to ignore.

The reason for this ignore-stance is that the CB's wish to retain control of the relative value (ie, exchange rate) of the world's currencies, independent of their real value vis-a-vis each other. This keeps the ascendancy of the OECD nations assured, as the rest of the world has no choice but to exchange their ringgits and bahts for dollars to purchase the engine oil for their economies. This can still be purchased with electronic "cash". But more and more the US and its vassal economies make it clear that this leaves your electronic cash hostage to the whims of the ruling elite who can stop or deter its flow because they feel your Sovereignty doesn't include the right to develop an industry they deem only they should hold the monopoly on.

So cash is trash when it can go in a flash, your teeth will gnash.when under the lash, the stash against a crash is proved to be mash.

Thus does the use of it as a weapon undermines its use as a currency, as it forces those pushed outside the system to use barter, which, by eliminating the need of banks as middlemen, reduces the (constantly escalating) cost and facility of doing business, which, since that is the only function of cash, undermines its value, even though its exchange rate can still remain the same.

A sail on a choppy current's sea: "Assault, sphere brutish, is not in our wars, but in our delves into imperialism."

Sheik's peer.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment