|

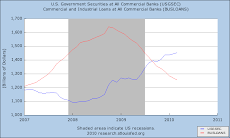

| When $ = electrons, the Current Sea provides Liquidity. |

The first, as in (coincidentally ?) first world's, or "pray as you grey, it'll just go away or they'll keep it at bay", is the same solution as for global climate change: do nothing and hope everything doesn't fall apart before you do. This is the Bernanke/Krugman/governments-in-general/Wall St. mantra.

Second are the Collapseniks: Survivalists, Kunstler, Dmitri Orlov, Derrick Jensen, Many Investment News letters and goldbugs: everything's going to hell in a handbasket (and the handbasket is badly frayed and you'll be pushed out of it anyway) and you're an idiot for thinking otherwise: get ready, move out of cities, grow your own everything, and stock up on gold and arms, ammunition and booze.

The third and most frightening in some ways, are the Progressives/Greenies/Techno-fix junkies: With the same fervor the survivalists have for Jesus, these ardent keepers of the faith rely on technological fixes for the solutions to the myriad problems technological enslavement has wrought. These are the Cisco engineers, the vocal-about-local, grow-your-own, solar panel, electric cars and recycling-as-salvation aficionados.

Then there's Chris Martenson of peakprosperity.com who, unlike Resilience.com faces the fact that, like Communism before it, Capitalism has already collapsed, it was just that Creditism replaced it so long ago, that it slid into place after the financial crisis of 2008 without anyone noticing there was a transition (and yes, there is a transition.com, a shadow of Michael Ruppert's site, fromthewilderness.com of the Bush era).

Creditism is an outgrowth of Capitalism, just as Communism was, but instead of giving all power to the proletariat, all power now resides in the hands of TBTF Banks and their unjailable, so unassailable, Officers. By extending credit to anyone, and thereby wrapping them in a straight-jacket of conformity and fiscal indenture, Creditism works in a more insidious manner, as we can see in Greece, or student loans, or ARM's: the victim is blamed for his imprisonment in debt, the Officers of the Loan having presented a rosy picture of the future happiness to their victim, hiding the risks involved and the price to be paid should a single payment over the span of thirty years be late or (shudder) missed. Adopting Lenin's dictum to "Give 'em enough rope", The Lending Tree, a better, more descriptive name for the FED, has given plenty of liquidity to water its federal reserve branches from which they will watch those who squelch on their debts swing.

Creditism is basically "Keynesianism gone Wild", for unlike the cyclical economic deficit spending used to smooth over lax demand brought on by a downturn in economic activity, Creditism, an offshoot of what Chalmers Johnson referred to as Military Keynesianism in his first of three books on American Empire, "Blowback", is built into the federal budget and is thereby transmitted to the overall economy in such a way that it becomes organic. Any attempt to decrease its input into the economics of Empire results in tremors to the underling economy that threaten to bring it to its knees. It is thus endemic, and as a scourge of sound money, epidemic.

But as suggested above, Creditism is as different from Capitalism as Communism was, because the very basis of Capital accumulation is not just undermined, it is systematically destroyed. As we can now plainly see, no conspiracy theory needed here, the stated strategy of the Fed is to undermine savings by ratcheting up inflation, with the express purpose of forcing savers to relinquish their cash, forcing it into the overpriced assets of the casino that is now Wall St., or it will simply be taken from them via a rapid and destructive inflation based on pushing the price of energy resources to higher and higher levels. This is not being done, as in the Bush era, as an anomaly, but as a bedrock foundation of the Global economic and Financial system: if energy prices collapse, they take everything else down with them.

The dynamics are really straightforward, and they have to do with peak oil production. At the turn of the century, as outlined in the WEO (World energy report) of 2000, there were estimated reserves of 3trillion bbl's of oil in mankind's legacy, of which approximately half had been consumed. That estimated has, since that time, at least doubled. Not because any more resources were found, but because the technology to access what was already known to be there was developed; but the price, in dollars and in energy, is far higher than it was for the first half, and the payback, ie, the profit derived from the increase in production of goods that the energy resources makes possible, are not nearly what they were in times past. There are many reasons for this, with the most obvious being globalization and the concomitant depression of wages it makes possible.

However, since the only paradigm known by the Banks and financiers and industrialists, is the magic aura of automated transportation held out to the working billions, car production and highway construction are integral components. But they are, as can be seen in the leading model, the USA, after a short time, not producers of wealth, but consumers of it. Masses of people buying cars that are produced in other countries robs the US of the high margins it enjoyed paying workers wages with which they could afford, as Henry (af)Ford said, to buy the products they produce. But, with Walmart's replacement of GM as the largest employer in America, the highest wages paid to a population have been replaced with the lowest, and they can only afford to buy units that are subsidized, buy gas that is priced artificially low, and ride on roads that, because they can no longer afford to have more taxes taken out of their paychecks, they cannot maintain, let alone expand.

That is, not without Credit.

Now, since the industry producing the cars was pushed into bankruptcy, all their newly-hired workers can no longer afford the products they produce, and yet, for a modern nation of cars to get its workers to, well, the workplace, the manufaccturers must extend them credit, not for two years or three, or even four. Most of the loans to workers must now be extended for five to six years, even as the price the cars cost and the profits the industry derives therefrom, decreases, and the energy and materials to produce them, increases.

This is the second symptom of Creditism: when profit from manufacturing is pushed down so low that the only way for the industry to survive is via ancillary services, such as loans, insurance, gas, and maintenance. This assures that, although the nominal price is in fact lower, the overall "price to own" steadily goes up. But the whole economic structure of industrial production is based on the economies of scale, but the scale has tipped to the other side, so that the products priced so low and bought with credit, flood the system and instead of deriving economic benefit from their production, society is turned upside down in order to accommodate the very artifact it turned itself inside out initially in order to produce. We're collectively like Jane Fonda in "9 to 5", when she tries to run a collating copy machine: when things go awry, she's so bewildered by automation run amok resulting in sheets of papers being shot out of the machine and flying all over the room, she forgets she can simply turn off the switch ... which we, of course, can't.

This is the result of the voodoo economics of Reaganism: the psychology of running up huge credit card debt in the form of huge unbudgeted defense outlays, in the belief that, if the populace that benefits from the stimulus provided by Military Keynesianism, or perhaps more aptly, Keynesian Militarism, doesn't have to pay the bill, but can push it off onto the next generation, their objections can be thereby muted and overcome, the same logic GW pursued as he pushed the last vestiges of Capitalism over a fiscal cliff into the depth of Creditism, where, in order to enter the workforce, one must first be straddled with onerous student debt, then crushing car payments, and on top of that impossible house payments, all at plum interest rates so the banks can stay fat and, just to make sure any dream of economic independence are crushed, state-mandated insurance for health, car, mortgage, and life, ie debt insurance.

This is how Reagan accomplished his dual mandate of destroying Communism and Capitalism at the same time, replacing them with Corporatism and Creditism, taking any voice the electorate had away together with free speech protection which is now enjoyed only by the monied Corporations.

I realize this is a scanty, bare-bones analysis of the metamorphosis our economic system has undergone in the last two generations, but the alternative, the Obama-stated State of the Union nonsense that, "The good news is, we can make meaningful progress on the issue of climate change while driving strong economic growth”, needs rebutting. The very basis of our lives has undergone fundamental changes, and whereas many believe that it can we can return to a gold standard, or that fiscal restraint, even as the FED's balance sheet balloons to such an extent that its planned size, by the end of 2013 will = 25% of the US GDP, is still a possibility, have failed to grasp the nature and extent of that change, and are instead bent on hoodwinking the public into accepting their new constrained and dwindling existence, where your I-phone, monitors every move you make, and you fight for the right to pay the cost for erecting the walls of your own prison cell.

In one of Zola's novels, he uses a runaway "Silver Streak"-type railway engine speeding toward a terminus, with those on board helpless to stop it, as an analogy of political cataclysm. It is just as apt as one for Creditism as an out-of-control machine hurtling us to our destruction, where any attempt to seize control of its levers or to stop the stoking of its engines has been abrogated by a political and militarily machine that condemns and vilifies anyone who tries, throwing them under its speeding wheels.

And because rationalization is a much more powerful force than rationality, few will even try, so on we speed until a calamity, in a process outlined in Naomi Klein's, "Shock Doctrine", forces a CPU reset, and then, just as she described, a Deus ex Machina will appear, and, as we've already seen with Ben Bernanke and Paulson, who were among those who all along said no one could've seen the Financial Meltdown coming, miraculously had a plan all ready to put into place a system that increased their power and wrested any vestige left of our own.

No comments:

Post a Comment