|

| Free harecuts for the balled.

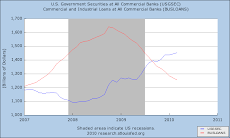

After each segment of a presentation in a seminar I was taking, the proctor would pause and ask, "So what have we learned?". After 2008, and now, watching as the Euro rises to $1.30, in terms of the global banking system, the answer is obviously a loud, "Not a thing". At least collectively. Some of the more astute observers of the rolling crises, Doug Noland of Prudentbear.com, being, as usual, not only among them, but heads and shoulders above them, have noticed that, just as the world was irremediably, irredeemably changed following the fall of Lehman's, the ramifications of the Cyprus imbroglio, were miscalculated by those who decided it should happen (it's been hinted that, just as Lehman's was to teach the markets a lesson they missed following the Bear-Stearns debacle, Russia was in the cross-hairs for the Cyprus take-down).

In economic theory, a situation where a party will have a tendency to take risks because the costs that could incur will not be felt by the party taking the risk. In other words, it is a tendency to be more willing to take a risk, knowing that the potential costs or burdens of taking such risk will be borne, in whole or in part, by others.

I'm sorry, am I missing something here? Is that not identical to the definition of the entire financial system? This is exactly what CDS were developed for. The entire unregulated derivatives market known as the shadow banking system is totally dependent on moral hazard. When all the banks are labeled TBTF, then that means, by definition, that the risks are borne, not by the institution, its officers, or its shareholders, but by the lenders of last resort, the tax-paying public. When Fannie Mae, Freddie Mac, and the FHA swallow whole, at 100% of their par value, CDO's, ABS and MBS, issued by the banks at interest rates of 3.5% for a mortgage of 30 years time, when inflation is artificially massaged to a much lower number than its real value, so that the losing nature of those loans is disguised, it is the banks, selling to the FED, a risk, the potential costs and burdens of which they know will be borne wholly by someone other than themselves: they who wrote the loan, booked the profits, collected their bonuses and padded their pensions, took none of the risk, the judicious weighing and evaluation of which, their elevated salaries and other compensations are based upon. And since the main underlying basis of the economy is now the housing market, then the major underlying basis of the economy is one completely comprised of moral hazard.

A term, by the way, which was in many articles having to do with the financial industry in general and banking in particular, that has, since 2008, completely disappeared from the discourse, for, I would suggest, the very reason stated above: that's all the financial system is composed of now, and that, for lack of a better word, is, always has been, simply a gussied up way of saying, fraud. Which suggests the other reason the term is no longer bandied about, because there's no reason to play such word games when the niceties of the vernacular are no longer needed; why use 4 syllables to describe what one does quite adequately? But since most people, have the wrong idea of what fraud actually is, I thought I'd include the definition I found on the most excellent Insitituional Risk Analytics website in a letter from Frederick Feldkamp, entitled, "Fraud is Fraud":

JP Morgan’s latest “whale-trade defense”—that “senior management acted in good faith and never had any intent to mislead anyone"—is self-condemning. Actionable “fraud” includes a right to rescind transactions based on innocent lies that mislead others. Those misled cannot sue for “damage” unless intent to defraud is shown, but rescission for innocent fraud is law throughout the US and other “common law” nations. Anyone misled by a false statement can use fraud to rescind transactions made with the liar in reliance on the lie.

To suggest otherwise is beyond stupid. No nation ruled by law can permit liars to PROFIT by lying.

A rather succinct way of implying that the US is no longer a nation ruled by laws, because, simply as an example, the Iraq War was waged for what were always, but are only now admitted to be, entirely trumped up reasons, in other words, fraudulently. Yet the Bush regime, its cronies and lobbyists, all profited most handsomely from this deception.

And yet, to further quote the IRA article:

The world’s biggest and “best” bank, responsible for assets supported by liabilities that exceed the gross domestic product of Britain, backstopped by the accumulated wealth of every citizen of the US, must not be permitted to assert lack of “intent” as an “escape” from accountability.

Yet the war criminals who destroyed a people and a culture half a world away are allowed to simply step down from power and go on to write books, give tours, do paintings of dogs while sitting in their bathtubs, without a whisper of the crimes against humanity they committed for their own aggrandizement having first made sure that the ICC would have no jurisdiction over their actions (President Bill Clinton signed the ICC treaty but President GW Bush “unsigned” the treaty in 2001, signaling his administration’s intent to commit crimes that could theoretically subject U.S. military and government officials to jurisdiction of the court).

But of course, that doesn't matter, only when the fraud reaches into your own pocket in such an obvious and direct way do people actually call it by its right name. Because just as the 'moneyness' of financial instruments such os CDO's and MBS's was proven illusory, the moneyness of money is now being called into question. What you have is not what you think you have, so although everyone's decisions about their future is based on their understanding of where they stand now, where that is is no longer an unknown unknown but a known unknown and decidedly at risk, as the Credit Crunch morphs into the Cash Crunch, with Cap'n Crunch Bernanke at the helm playing the role of Ahab, spreading fraud by hiding risk as he mono-maniacally chases after the White Whale of asset-price-support as the Pequod economy gets engulfed in a maelstrom of his own making. The Empire always strikes back, it is true, but it is becoming more and more apparent to a larger and larger segment of the population, that as the unknown unknowns become known unknowns that were secretly known by those in the know, sooner or later the Empire strikes out. And that will be a Foul Ball indeed.

|

Monday, March 25, 2013

The Ideas of March: Hare cuts for Easter, Bunny.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment