|

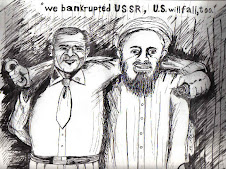

| Hapless Stock Analyst and Trader. |

I'm always reluctant to start a new post these days, as my screen quite regularly fades to black leaving me looking like one of those old-fashioned photographers, with drapery covering me and the screen to enable me to read the fading pixillation. Right now it's bright as day though, and I can't resist making an attempt to write something about the controversy (well, it's not really, just another in a long list of phony ones) about the bubble nature of the stock market.

What got me interested in the subject again wasn't only Doug Nolan's reference to Galbraith's wonderful little book, "A Short History of Financial Euphoria", (which I have here, together with Shiller's "Irrational Exuberance" and Kindleberger's "Manias, Panics, and Crashes"), but an article written and posted by Agora Financial's "Trend Playbook" that's entitled, as if they know, "Popping the Bubble Myth", written by Greg Guenthner, CMT (What's that pseudo title? Certifiably Mad Trader?).

The first indication that his article was going to be pure nonsense was, of course, the title. If something's a myth, then there's absolutely no reason in the world to 'pop' it. Myth's are, by definition, well, myths. But Greg doesn't care about that, he's upset because, "Look, I’m sick of reading about bubbles—no matter what the conversation (Really? Even if your talking about laundry soap?). It’s clear that the 2008 crash remains a psychological burden to most investors. So they continue to categorize any rising asset price as a bubble".

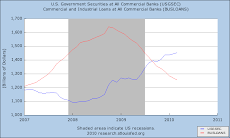

Any rising asset Class? You mean asset classes, such as bank stocks, or the entire stock market, or housing, all of which are elevated, not by myth, but by the fact that the Fed, the most powerful Central Bank in the world, is unabashedly manipulating the monetary system for the STATED purpose of elevating those very asset classes? This in the most vociferously Capitalistic country in the world, that is so encumbered with bad debt that none of its banks can afford to pay their depositors a nickel for the use of their money, never mind that the banks have a monopoly on money in what's a purportedly free enterprise system. The housing market's defunct and would collapse into ruin if it weren't for the deductibility of mortgage interest, it is only by the actions of the insolvent institutions at the center of our government, the FHA, Fannie and Freddie, buying up all the mortgages that the banks issue because, after more than five years since the crash, there's no private market for them, and there's no way banks can make money at the ridiculously low interest rate being charged, once again to people who, per the Feds own estimation, would be unable to afford to buy a house otherwise, and yet, unless deflation's what the Fed's expecting, what institution would lend out money for a period of 30 years at less than 3%? Never mind general inflation, that won't even cover the rise in their own healthcare expenses.

So the largest part of the economy is not only moribund, but, despite unprecedented prodding, refuses to budge, indicating that the prospective buyers of said properties are already up to their eyeballs in unpayable debt, burdened by healthcare insurance costs that are rising far faster than their paychecks can keep up with, employed at industries that simply can't, as evidenced by their own (income) statements (Apple, perhaps?), afford to pay them , nor even their taxes.

Now, in a system where Corporations pay for none of their externalities, those externalities, such as disposal of their toxic products, and the education of the work force they need, and the infrastructure over which their products are delivered to vendors, are paid indirectly via Corporate taxation, but when the only entities in an economy capable of charging a price based on production costs and all these other factors, can't afford to pay their taxes, it is quite obvious that they are extremely overvalued, can't afford to pay their workers, and in this case, the most successful company in the country, perhaps even in the world, can't afford to pay, never mind their fair share, but any share of the costs associated with their stellar profits, how can workers, who have NO voice in determining the amount of their paycheck, be expected to buy property, which at least gives them a roof over their head when its price collapses, or stocks either, which don't. All that money that represents the saved energy derived from years, and even decades, of hard labor so that it can be used to cover those times when earning tumble, and that they, understandably, don't trust the rickety roller coaster referred to as "The Market" to return at all, never mind all the attention, anxiety, and outlandish fees paid to traders to try and 'grow' it on the toxic fumes emanating from the pile of toxic debt with which it's fueled.

But Greg goes on with one nonsensical statement after another, however the real point is made by Upton Sinclair's observation that, "You can't explain something to someone if his livelihood depends on his not understanding it". And traders are dependent on your not understanding that the stock market is so rigged, so unreflective of the economic condition of the US economy, that it is a very dangerous place for retail investors to put their cash. Yes it may grow faster than it would in a CD, but then it will be vaporized faster as well. For a good example, that's more timely than 2008, we need only look across the Pacific @ the Nissei, which, even as Greg was penning his absurd article, was already plunging, from a recent, all-time high, to which it was propelled by JCB-manipulated euphoria, to a 14% correction, demonstrating more than anything I can further elaborate, the rapidity with which 'money' can be vaporized in our new world of e-cash.

Yes, your cash is having its valued siphoned off as it sits in a bank account, but when you 'invest' it in the stock market, the destruction it's prone to there is always considered to be of your own making. You made bad investments, so it's because of your lack of investing acumen and your failure to perform due diligence that's responsible for your deserved, it's always deserved, penury.

It is always and everywhere only to hide the fact that money is not a store of value in any fiat monetary system that those in power push people into investing in the stock market. From there, they can clean you out, and put the cash they've hoovered from your pockets into government-insured FDIC-like accounts in other currencies that DO pay interest, while you languish in your trailer, if your lucky enough to have one.

Money has been debauched to such an extreme that it is useful, for now, only as a means of exchange; it's use as a store of value hijacked by fraud and electronic simulation. Because, the cost of energy and the enormous wastefulness inherent in the internet infrastructure is what money is now, not what it represents. Electronic transfer and instantaneous monetary creation can only occur via an unwieldy, constantly attacked, via cyber-pirates, enormously energy-intensive, power-sucking whore whose costs and complexity grows at a far more rapid rate than the value of the money which supposedly undergirds it. That is why the precarious situation in which it's balanced can never improve, because its value is constantly eroded by the costs of the electronic cloud in which its ensconced. This is a fact known to every banker, politician , and market trader pushing buttons and e-trading your assets from their comfortable pad: it's all magic, a conjuring trick creating vortexes into which first your money disappears, after which, so do you.

No comments:

Post a Comment