|

| A San Francisco Bay, the Cry from the Wilderness. |

As the New Year started I read some bad news regarding my favorite writer on the internet (all my favorite writers are on the internet), as journalism has left the building, there is no other source of analysis that is anything but propaganda, almost as though Soviet-era TASS has become the standard to which every hack aspires.

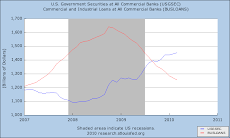

The writer I'm referring to is Doug Noland, a commentator on Prudentbear.com that stopped posting his chronicle of the Bubble economy at the end of 2014. Why this is especially bad news for yours truly is that I had been rather faithfully copying his weekly column for some years now, but had lately decided that, since they were all archived on the site, why was I bothering to retain them on my own drive? The question was answered when I went to make sure it was true that he was gone and saw that not only is he gone, but the site has been renamed to "Federated" and is now a mere advertisement for their investment and Dollar portfolios that "offers investors a broader diversification approach managed to limit losses or pursue opportunity when markets, stocks and (in the case of Federated Prudent DollarBear Fund) the U.S. dollar are in decline".

This is a devastating loss to the hope of having any objective analysis of events on the internet by a professional not interested in pushing his own agenda, but who had been for years posting his view of where the markets were going and, more especially, where the world economy was heading, as it was lead by the Fed and other CB's down the path to another "Goldilocks" economy, an appellation used during the mania of the Bush years to somehow make us feel happy that the entire economic system was being likened to a Fairy Tale: a story told when the economy was on its

... way to a dusty death, lighted by fools.

Out, out, brief candle!

Capitalism's but a walking shadow, a poor player

That struts and frets its hour upon the stage

And then is heard no more: a dusty tale

Told by multiple maniacs, full of sound and fury,

Signifying nothing.

This dynamic never changed, and in fact its denouement is occurring right in front of our eyes, and yet, the one person who could give us a cogent analysis of it with neither blinders on nor hidden agendas to obfuscated his view, has disappeared. From his October 3, 2014 post, comes a clear warning when all other voices were silent:

"Never before has global finance operated without restraints on either the quantity or quality of Credit – no gold/precious metals regimes, no Bretton Woods, nor even a functioning dollar reserve system to place restraints on Credit expansion. Moreover, Credit expansion has come to be dominated by non-bank finance, removing important traditional constraints to financial excess (i.e. bank capital and reserve requirements). Over time, the inherent instability of unfettered global finance has evoked progressively more “activist” central bank control over “money,” Credit, the financial markets and economies. And this market intervention and manipulation has fostered the greatest ever speculation in global securities markets – which has motivated only greater central control."

Being a bit more of a polemicist than he was, I can't help but speculate as to where such a state of affairs will lead us, what such a configuration might suggest. Because when an institution that supposedly prides itself on its independence has tied itself to the mast, its freedom to navigate dangerous uncharted shoals is based then on happenstance, having given the reins to fools who can claim with a straight face that, "Nobody could have seen this coming", when in fact everybody saw it coming, but were too frozen in panic to be able to contemplate doing anything that would rock the boat, or more accurately, would leave their fingerprints on the rudder at the moment the ship smashed against the rocks of reality.

"Back in the late-nineties, I was convinced there was a momentous evolution in finance that was going unrecognized both in the marketplace and at the Federal Reserve. I believed the Fed would move to responsibly check the explosion of non-bank “Wall Street finance” once they recognized how it was fomenting destabilizing impacts on asset markets (price inflation and precarious Bubbles) and distorting resource allocation to the detriment of the real economy. How dead wrong I was. They instead embraced asset-based lending and became a proponent of leveraged securities speculation. Indeed, manipulating the returns from financial speculation became history’s most powerful monetary transmission mechanism. Borrowing from a Chinese proverb, central bankers jumped on the tiger’s back and can’t get off."

What that real economy he mentions consists of, or should look like, we have no way of knowing, because the cancerous financial economy has distorted it out of all recognition. But what it apparently ISN'T, as we have witnessed in the pat six months, is $100/bbl oil fueled by scraping the bottom of the oil barrel by fleecing the public as it once again puts every dollar they earn into producing more and more of a fuel that is burned by more and more internal combustion engines in a world burning up from so much carbon in the air it is changing the very air we breathe, the very climate we exist in, the very oceans whose waters we are immersed in. What Mr. Noland never mentions, because rabble-rousing is not his schtick, is that Central Bankers may have been the ones that jumped onto that tiger's back, but it is the populace and the economy on which that populace depends for its sustenance that will get mauled when they get thrown off of it. That is the result of the change he witnessed in the 90's in the financial sphere, not just that money creation was taken out of control of the Central Bankers, but that money/credit creation was now built on risk dynamics that rewarded reckless speculation and punished prudent investment.

As a current example of this, witness the interest rate on your savings account: low, and as the recent actions of the SNB are highlighting, diminishing, not increasing, whereas, whenever you use your credit card to delay payment of your liabilities, the amount that the banks rewards you as you hopelessly Chase Freedom, is INcreasing, such that savers must pay banks to retain their funds while those who charge items on their credit cards, which, by the way raises the costs of doing business for the merchants by 2-3%, yet can net you a 5% "reward" bonus. All the risk, that financial professionals are supposedly paid to manage, is now instead pushed onto the public.

A comment from Rick Santelli explains: "And there’s lots of talk and even comments by Ben Bernanke, Janet Yellen and many commentators – that the central bankers need to dabble in that direction, for an obvious reason: because of the politics, whether it’s the politics of Europe, the unsure nature of how Germany wants to stand up and stand its balance sheet along with the ECB’s, or in this country because there’s a logjam. Things can’t get done at least to the liking of the masses, to the citizens - to the voters. But what that really has done is it’s taken the voters out of the game. If central bankers didn't have such a large foray into politics, well, politicians would have had to sink or swim on the merit - or lack therein - of their policies that weren't creating the growth. But central bankers early recognized that they needed to buy time to create stability and the growth would surely come. But the problem is, in the parlance of trading, is that the spread between these two [growth and stability] continues to get wider and wider and wider.”

There's a reason for this, and this is where I part ways with such reasonable people as Doug Noland maybe Yves Smith, and other commentators on the web: What the public wants and demands, from my experience here in the US, and what the economic system, as structured, can deliver, are at odds, and it is the spread between THAT that is getting wider and wider.

The reasons for this are manifold:

1) The intractable nature of the middle class, that recognizes global warming, and even the cause of it, but maintains in the face of all reality that they can simply green up a few items and the entire edifice of our fossil-fueled expansionist suburban dystopia we consider essential for our future can thus be maintained.

2) Strongly related to #1 above is the ridiculous and self-serving notion reiterated yet again in the NYT's front page article this Saturday calling out 2014 as the hottest year on record, that it is the "Climate -Deniers" who are to blame for inaction in the Global warming arena. This is patent nonsense. As though it could ever be a surprise that those least willing to do anything about a phenomena are those people who refuse to acknowledge its existence,

3) It is precisely this middle class that is insisting that all the systems put in place during the heyday of Industrialism in their economies, most of which have striven over the last generations to rid themselves of Industrialism's more toxic trappings, should function as planned despite the fact that they have actively worked at removing the very industries that were underpinning their dreams of a comfortable future.

4) Because of the above, trying to maintain the status quo becomes increasingly desperate. Because by blaming a minority for what the majority is responsible for, one need take no serious look at one's own carbon footprint and need never therefore take any steps to decrease it, and in fact, judging from energy use world wide, take steps as the economy forces one to, that are contraindicated given what you know about the role of carbon in the debacle we are creating.

5) Democracy that we have so proudly, one might even say arrogantly, foisted on the rest of the world is therefore proving its complete dysfunctionality when confronted with anything that even a minority, and despite all the ink spilled to suggest the contrary, a rather small minority, disagrees with, despite the fact that it's something as momentous and ominous as complete destruction of our world as we know it.

And that's what leads to the Central Banks of the world trying to do monetarily what the politicians can't do fiscally: tamp down growth while pretending that they are trying to do the opposite. Because the only growth industrial societies, even ones that have off-shored that industrialization (I would argue more so, because now the cancer has been intentionally metastasized to another point in the world body where it can grow even faster, as it isn't being monitored there), in their paucity of imagination, can come up with is growth in automobile manufacture. Automobile manufacture not even of the green manchines on which our future energy independence supposedly teeters, but in the good-old-fashioned 100% internal combustion engine variety. No worries about hydrogen machines, or all-electric or natgas, or even hybrids. The vast majority of the ever-increasing wheeled vehicles being rolled off assembly lines worldwide in order to pump up demand for gasoline and spur growth, even growth that locks us into fossil-fools future, are gas-burning petroleum-dependent vehicles:

Consumers bought more pickups, minivans and sport utility vehicles than cars in every month of 2014. The full-year vehicle sales will likely total 16.5 million and cap a 58 percent increase since 2009. Trucks like the Ram 1500 and luxury SUVs such as the Cadillac Escalade command higher prices and fatter profits than most passenger cars. And would be completely unaffordable to most knuckle-dragging climate-deniers. The people buying these vehicles in the face of the evidence as to what is the cause of Global Warming are exactly what they claim their Republican lame-brain counterparts are: they are Climate deniers. Every person getting on another jet for yet another trip to yet another tropical destination are doing exactly the same thing as the Climate-hoax crowd: denying climate change. They act exactly as though nothing is wrong: Hello!? That's why it's called denial!

In this atmosphere of middle-class intransigence and Congressional and other legislative bodies' compliance with striving to maintain a dream even as it morphs into nightmare, the outbreak of political turmoil around the globe is as predictable as it was in 1914, as is the penchant for blaming everybody else and declaring them "inhumane" as we work assiduously to destroy everything on the globe for the luxury of tooling round in a Mad Max world while sneering at those who "Don't get the Science", to use one of the pedantic phrases of one of the leading exponents for Life in the fast Lane, because, well, you deserve it, Paul Krugman. That is the real inhumanity, When people who can make a difference, when people who know better, act exactly as though they didn't, pretending the link between cause and effect is nonexistent as long as they spout the right platitudes and profess the correct position.

And while Doug Noland never really addressed this causal link, the fact that he gave such spot-on analysis of just what the dangers of pretending everything is all right in another, closely-related sphere of arcane activity were, and how they could carry on unimpeded and undetected by the vast majority of lives that they affected, was like a tonic washing away the layers of bullshit spewed continuously from the print and broadcast media. But now that voice is silent, and an anchor of intellectual honestly and stability has been lost. He will be sorely missed, if only be the few who were aware that he even existed.

No comments:

Post a Comment