|

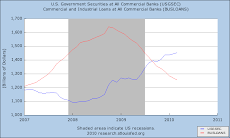

| BernAnkheehee: King of Comedy Central Banking. Hid the very real Costs of the Free market. |

Doug Noland, at http://creditbubblebulletin.blogspot.com, ended his post last week with the statement:

"There’s always a vulnerability associated with money – and “Moneyness”: crises of confidence are inherently highly destabilizing. There’s a shock when holders of perceived risk-free “money”/securities/derivatives come to realize their previous misperception. As confidence in both economic fundamentals and central banking wanes, I expect already problematic fund outflows to accelerate. A tightening of financial conditions portends Credit problems way beyond energy and mining. I hope I am much too dire. Acute systemic risk on a global basis is The Big Issue 2016."

This week, his post began with this statement from the Fed:

"January 15 – Bloomberg (Matthew Boesler): “The U.S. economy should continue to grow faster than its potential this year, supporting further interest-rate increases by the Federal Reserve, New York Fed President William C. Dudley said. ‘In terms of the economic outlook, the situation does not appear to have changed much” since the Fed’s Dec. 15-16 meeting".

I valiantly looked for the post of my own in which I do a similar juxtaposition with Noland's assessment vis-a-vis that of the Fed regarding the crash of 2008, wherein the Benron assures us all that the damage could be "Contained". Noland counters with words to the effect that, if there were any more ominous sign of things getting ready to implode than the ones we were seeing, he couldn't think of any. However, I just couldn't locate it, and reading through too much of one's own writing becomes tedious rather quickly, so suffice it to say that the parallel between then and now couldn't be more unnerving. Let's remember, this is the Empire, Benron carried on, got re-appointed, set up the old scams with a coupla extra guarantees to foist the costs of the Masters of the Universe's mistakes on to the public while tossing a few more trillion$ to the rich to assuage their frazzled nerves. He then went happily on to luncheon engagements fetching a quarter of a million dollars each. Doug Noland, the person who was technically "right", couldn't have been more wrong. So he's still writing his creditbubblebulletin (thank god!) while the Son of Maestro rakes in the bucks enabling more insider trading.

No wonder even financial writers can't help but notice that:

The global inequality crisis is reaching new extremes. The richest 1% now have more wealth than the rest of the world combined. The world's 62 richest people hold as much wealth as the poorest 3,500,000,000. Power and privilege is being used to skew the economic system to increase the gap between the richest and the rest," Oxfam asserts, adding that "the current system did not come about by accident, humanity can do better than this."

No matter how amoral one may be, no matter what one thinks of this heinous fact, assuming it is one (I'm seriously not in possession of the resources that I would need to verify Oxfam's statement), what we do know is that a concentration of the larger part of the proceeds from people's labor continues to go to a smaller and smaller coterie of well-situated individuals, and as Paul Krugman stated at the beginning of the Great Recession (what would, at any time in our previous history, have simply been called what it is, a depression ... but these days, we must be molly-coddled against reality lest we "panic"), the "Paradox of Thrift", will never lead us out of it.

How economists define this paradox, as per the Krug, is, since consumers see their spending power erode and realize that they are further in debt than they can afford to be, they cut back on spending. As a population does this en masse, as they are wont to do during an economic slowdown wherein they see their fellow employees and relatives losing their jobs from no fault of their own, the economy slows, as consumer spending, the main driver of the economy, plummets.

Contained in this little kernel of wisdom are the three irreconcilable problems with capitalism that we prefer, at least here in the Us of A, not to mention, let alone discuss:

First, obvious as it is, Krugman and his ilk totally miss it. If the 1% basically have all the money, it is THEY who control the economy, and it is THEIR amassing of all the money in the world into their own hands, with which they clutch it greedily, using it only to scour the world to see how much more of it they can concentrate into their own clinging primate hands. And because they skim from the economy as a whole, the more the consumers go into debt to follow The Krugian advise of spending yourself into an inescapable abyss of debt, the MORE the remaining assets of the globe get funneled, intractably and inescapably, as into a black hole, into the hands of the 1%. Oxfam's statement that "Power and privilege is being used to skew the economic system", subtly intimates that Capitalism needs to be "skewed" in order to get the inequality it needs for it to function. It requires no skewing, just, let's see, how did the adored avatar of Cowboy Capitalism put it? Oh Yes, " ... get the government (ie, Democracy) out of the way so that the entrepreneurial spirit of the American people could be unleashed". And unleashed it was. The so-called people are American Corporations; that entrepreneurial spirit he boasts of is the lack of any tinge of moral responsibility for either the damage wrought or the victims caught up in the series of cooked up scams Cowboy Capitalism gleefully entraps them in. The government he was elected to to make sure it was all done legally was simply handed over to Industry that now turned its formidable intellectual abilities toward fraud, confiscation and sequestration of profits to hide from the tax man. And that's how 62 mobsters get to have more income than 3.5 billion people. Capitalism serves only the needs of those who drive it, it needn't be skewed for it to operate that way, that is how it works. And 62 people, no matter how much they spend, are not even close to having the ability to spend on as many diverse objects and products as 3.5 billion do, and thus, can not a consumer society make.

Second, capitalism is cyclical in nature. The generation that grew up after WW2 thinks that how they lived was Capitalism , but it was socialized so as to function for the entire society for the simple reason that the motto of the day, "we're all in this together", was the dominant meme, necessary in order to get public backing for the War. Before WW2, however, was the Great Depression, and before that numerous other depressions, all coming at regular intervals as the rich stored up their hoards, then too greedily invested them in new financial adventures or wars, whichever paid the most, only to have some of them fail. This mechanism is how their ungodly gains were recycled back into the economy, as they went bankrupt, new enterprises arose to take their place and make new investors rich. This processing of dollars from failed schemes back into the economy is part of the natural workings of capitalism, but it has been purposely short-circuited by a Fed that's been completely bought by financial interests, for it is they and they alone who the Fed considers when making their decisions, actually bragging that they are 'independent' of political pressure when they make decisions for the entire economy. By 'political pressure', they mean the same voice of the people Reagan wished to just shut up and go away. The Fed was instituted specifically to keep those voices muted. The results of which are that the costs of malinvestments, instead of forcing the over zealous, over-leveraged, and hence greediest into bankruptcy, are rewarded for their stupidity, since the price of their folly is instead extracted from a public that is totally unaware that when an agency such as Ginnie Mae, or Freddie Mac go belly up, it is the Public, yes, that 's right, all of a sudden, lo and behold, there is such a thing as 'society', and it is society that has to pay, forced into doing so by their own elected 'representatives', for all the losses of those who just a month before were stuffing their pockets with the profits that they "earned" and to which the government, meaning the rest of society, has no right to a nickel of.

Which brings us to the third built-in contradiction of Cowboy Capitalism, that it is not a system of governance, or even of economic forbearance. It is, by its very definition, a system of the ascendant, for the ascendant and by the ascendant. That is what Margaret Thatchface meant when she said, "There is no such thing as society." There is only money. And it, by right, belongs to those who have it. You are merely a resource, a barely human resource, and if the moneyed want to use you, in order to increase their holdings, all well and good. If they deem they don't, out you go, now fend for yourself, sucker. Basically a form of slavery called feudalism, whereby the wealthy have no vested interest in the well-being, or even the being, of the dregs of humanity, which is what they consider the rest of us to be.

When Oxfam makes the claim quoted above, that "humanity can do better than this", they are quite wrong. Humanity, in the form of the Soviet Union and their imposition of Communism on the Soviet Republics, tried to "do better than this", but, at least partly, because of the White Russians, ie, that part of the population that considered the vast riches produced by the peasant class to be their own, took whatever wasn't nailed down and fled the country. They gathered in the Capitals of Europe whence they received arms and funds to destroy the nascent revolution, thereby forcing it into the channels it took. This is why in the current state of affairs, everything is monetized, because the Aristocracy can then shift the riches of the entire Nation, which, by right, beLONGS to them, out of the country with ease.

If the Loyalists, to a King in a foreign land to whom everyone who fought in the American Revolution had sworn an oath of loyalty (hence the name, "Loyalists") in the nascent USA had had the power to do the same thing to the young country, there would have never been a Democratic government, as we can see from what actually did happen. Feeling besieged on all sides John Adams signed into law what was basically the Patriot Act of its day, the Alien and Sedition Act, which, had its provisions been followed, would have resulted in much the same rule by paranoia that took over the USSR, and then, ironically, swept the USA during the McCarthy era, purging the last vestiges of free speech from the government. Prior membership in the communist party, even during the years we, the Great US of A, let the Russians fight Hitler alone, but during which time we, nevertheless, were their ALLIES, was, despite something called the Constitution, in which the right to freedom of association is explicitly "guaranteed" (as long as those you associated with were right-wing capitalist zealots), got you hounded out of your job and blacklisted so that no one could dare hire you, lest they too have their livelihood destroyed (which, per the GOP ruling platform, is, for all intents and purposes, a death sentence: the GOP wants no unemployment insurance, no disability insurance, healthcare, nor even social security).

None of which is meant to say that communism wouldn't have failed of its own internal contradictions. But the simple fact is, we don't really know, never will, since it was never given a chance. The Russian aristocracy, believing, as do all Aristocracies, (the pablum of "Downton Abbey" notwithstanding), believed that, despite their having never performed a lick of work to buttress the claim, the country in which they reside belongs to them and exists only by their leave.

But an aristocracy is nothing more than communism for the few. The rich have what they do, not because they have done anything to merit it, 99% of them got it handed to them by inheritance, resulting in what has, in Western minds, become the overarching feature of communism: One Party Rule.

And as the highly-placed like to keep reminding us, the Party is one to which we are most definitely NOT invited.

"Now the sophisticated players must contemplate beating the unsuspecting public to the exits." A statement with which I take away two notable objections. One, maybe to you good-ole boys, whose bad judgements and malinvestments are covered by the public, this is just a game in which we are just "players", but to the rest of us it's deadly serious, we have no fallback, no recourse to a money-pot with which to get back in the "game" you so haughtily refer to it as. And secondly, why, oh why, is it an "unsuspecting public"? When the market cycle took a generation to spin off and crush its participants, thus giving them a chance to forget, the cycle is now an eight year presidential term, perfectly predictable and perfectly reliable. So if the public is indeed unsuspecting as stated, then it is hopelessly stupid too. Or at least naively trusting, for even a skeptic like Noland states, "The bulls, Fed officials and most others see the economy as basically sound", so at least you're in good company.

However, first of all, most of them are players in the game and it is therefore in their best interest to say they believe the economy is basically sound, and secondly, what is sound for the overall capitalist economy, as the explanation of the Thrift Paradox elucidates, is anathema to the pawns usually referred to as investors. Investing opportunities are basically the financial industry's version of click-bait: a proffered incentive to get you to spend your resources on something that will benefit only the Street, the investment newsletter industry that churns out Market propaganda to reel in the gullible, and, of course, Fed officials themselves who are paid a sinecure. It matters not what they say, do, or report to the public. They are never chastened for being wrong, never even opening their mouths to argue with the Chariman, but merely collect a fat paycheck of much more substantial sum than you will ever see, in order to just show up. and nod to whatever the Chair's Yellen.

Speaking of the Fed, before ending this post, I'd like to list some indicators of just how a free market functions when that free market is in the USA:

One, that part of the market that creates money, the Banking system, at the end of every cycle, does so by extending loans to people and companies that haven't a prayer of ever paying it back. Because of which, said money is purposely inflated by the Fed, as somehow this has become their "mandate", in order to stoke "animal spirits", despite the fact that the smooth functioning of the Market also requires "rational man" to be making decisions. These two Fed-inspired concepts contradict one another.

Second, is the Market. It is beyond the shadow banking of a doubt, manipulated not only by the Federal government's PPT, but the Fed's QE programs. The Plunge Protection Team is a name coined after President Reagan set up a “working group” between the government and the Fed to make recommendations on how to maintain integrity in the markets after the 1987 stock market crash. It is the precursor of the Fed's purchasing of MBA's that the private market wouldn't touch as they were too toxic. So not only money, but moneyness itself, bonds used as leverage to create the illusion of stability despite what the entire system was leveraged on was quicksand. On top of outright fraud, there is also the Bernanke Push. The stated intention of the Fed to force you to take your money out of your savings accounts, ie out of cash, and plow them into riskier "securities", you know, like MBS that are rated AAA, by rating firms that are paid to rate them AAA , and the stock market. This is just one of the overt methods used by the power elite to push individuals investors to move cash into less liquid securities where it can be warehoused until another recession, which the Fed will inform the public is occurring only quarters after it has commenced, insuring that the retail investors get out only after the dollar value of their investments have taken a substantial hit, the inside traders having taken their money out long before, once signalled by the cognoscenti when to do so.

Third, Commodities. Specifically oil. The most essential of them. Its price, whether by Reagan/Bush GW Bush, or Bernanke, has been purposely manipulated for decades by the very same people who are the most staunch advocates of Free Market Economics, even as they collude to drop it precipitously, raise it unprecedentedly, or threaten to keep it in the ground altogether.

Dollar pegs. How can there be any semblance to a Free Market when the participating economies peg their currencies, rendering the value of the currency, and therefore their underlying economies, indecipherable?

Global Reserve Currency. When a currency of any nation is used as the currency of the globe, it no longer, if ever it did, reflects the value of the economy of the issuing Sovereign. How could it? As we are seeing right now, the dollar's value is increasing even as the economy is sinking, because other economies are sinking even faster, so demand for dollars goes up .., not in order to purchase US goods, but in order to dump their own country's plummeting currency. So the dollar becomes for foreigners what it can never be for US citizens: a store of value. A Russian oligarch who sold rubles for dollars, having been informed that the US was going to impose sanctions on the Russian Federation, has retained his net worth somewhat at par, whereas a patriotic Russian who stayed in rubles as a show of support for Putin, has watched his own net worth fall off a cliff. But the American citizen who was in dollars at the same time, just by the Fed's stated goal of 2% inflation, has lost net worth.

Making a nation's money the reserve currency is for the purpose of geopolitical domination and has nothing to do with the security of the citizens of that country. A transactional currency, unowned by any sovereign State, is what is needed to replace the reserve currency status of the dollar, so that the dollar can become a real store of value, a status no currency currently enjoys: they are all fiat currencies. Consequently not a single one does what a free market is hailed as having the capacity to do: represent the value and productivity of the underlying economy that produced the GDP amount stated. Therefore the bonds they issue and the interest rate paid to purchasers those bonds, have no relationship to either one another or to the ability of the sovereign that's issuing them to pay the loan they represent back. Therefore, like their currencies, their bond value is also set by fiat: they are worth what we say because we say they are worth it ... that is, until you want to actually cash them in.