|

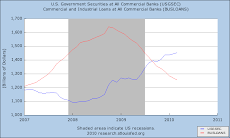

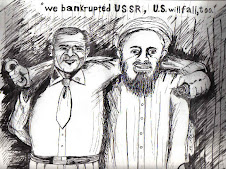

Too much Crack and Cable: facing an unclear winter of discontent. |

Of, course, what he really means is confidence in "Regulation-free Markets", which is not the same thing. Summers is famous for his stark blandishment, made in 1991 while at the World Bank, that developed countries ought to export more pollution to developing countries, such as China, because those countries would incur the lowest cost from the pollution in terms of the lost wages of people made ill or killed by that pollution due to the fact that wages are so low in developing countries. He further stated that, "the economic logic behind dumping a load of toxic waste in the lowest wage country is impeccable and we should face up to that" (ie rake in huge profits from it to enrich ourselves and ensure our continued full spectrum domination of the econo-sphere). The Netherlands, by the way, got caught doing exactly that: dumping horrible toxic sludge in Nigeria, last year, after shipping it around for weeks to cover their tracks. But like our financial geniuses, they got caught with their shorts down...and if you've seen the Wall St. boys, you know that can't be a pretty sight ...talk about toxic waist ... eewwww.

|

| Beijing smog: Nothing to see here. |

So what might those policy choices be, we ask? Even after the fall of Summers from his position at Harvard and now that he and Scholes, (that other Master of the Universe who brought us the LCTM debacle, which started the whole Greenspan-led Fed precedent of gross interference with the still-called Free Market every time the Spoiled-Brat-Frat Rich-Boy Club brings it to its knees using it as their private gambling Casino), are still asked their opinion, it's plain they're feverishly working in the background to kluge together another graft to their money tree, replete with loopholes they can use to continue to game the system for their own aggrandizement.

It doesn't augur well this time around. And the reason is what Stuart Thomson's states at the beginning of this post: Trust. The world held its breath as it marveled at the spins and loops of the economic roller-coaster, as long as the party kept going and they were making money. But now that it's been revealed to the world the sheer scale of the losses with which Wall St., abetted by their cronies in Washington, (and London, Berlin, ... Hong Kong) intends to stick them with, they're not so anxious to pony up for the next hair-raising hair-cut. Now that caveat emptor's (Buyer beware, or at least be wary) been rewritten to the unabashedly blatant, "Step right up, Suckers, there's one of ya born every second", they've lost their appetite for being Wall St.'s saps.

Good luck boys. But methinks that what Yu Yongding, the former adviser to China's Central Bank, said about the impending implosion of the two Enron-style SIV's we refer to as Freddy Mac and Fannie Mae, is spine-tinglingly apropos: "...it's catastrophic. It's the end of the current international financial system".

Sleep tight America, now knowing that the little Foxes are frenziedly networking to cover their collective fat ass, disguised as the stewards of your Security, whilst caring only for their own: Faith-based Economics is hopefully headed right where it belongs ... into the dustbin of history.

No comments:

Post a Comment