Quoting Mike Rapoport of Dow Jones Newswire, Julian Delasantellis says, "Wachovia Bank, just bought out by Citicorp for $2 billion, had on its last day on its ledgers assets with a book value of $75 billion", and goes on to say that, "Maybe its not that asset values are too low - maybe the entire crisis is the markets telling us that they're too high". To which I can only reply, "Bingo".

While many point the accusing finger at minority borrowers who took out loans they couldn't afford, they were, many of them for the first, and what may prove to be the only, time in their lives, given access to sums they couldn't even begin to wrap their minds around, by "experts" who cajoled them with blandishments about "the ownership society" and "The American Dream".

These experts were, many of them, new to the business themselves, they took their cue from the likes of Mozilo, Fuld, O'neal, and Prince, Charles who played the music to keep the dance going. That dance being the Chicanery Waltz, a ponzi scheme contrived to fool the citizens of the US and the Central Banks of the world, that the imploding US economy, stripped of its manufacturing base, inflicted with middle-class expectations, even while straddled with a shrinking lower class income, and facing an inevitable crisis from the advent of peak oil production, was really robust and "resilient". It was neither.

What it was, was an economy thought by the cognoscenti to have too much money in the hands of the government and the hoi polloi, and this was what the Friedmanites were, and are, hell-bent on changing by, for one thing, scuttling Social Security, and siphoning its wealth, accrued by that very same government they purport to despise's ability to tax its citizens, into the hands of the rich financiers on Wall St. to underpin their failed dystopian dreams of a Spree Market, wherein all the wealth of the nation flows into their hands and is then disbursed to their investments in far-flung lands, leaving the populace, whom they despise and denigrate as morons, bereft of their life's savings (their definition of "Freedom" ... you're no longer encumbered by those nasty, onerous investments), without healthcare, and helpless to stop them, as we will be too old to recoup our losses.

Instead, they "free up" those savings to invest in factories and manufacturing facilities overseas, protected by the military you pay for through taxes on those now lower-paying jobs. Naturally the value of the US economy, now bereft of its productive capacity, can only diminish going forward; so a new paradigm needs to be invented to put lipstick on the slaughtered hog.

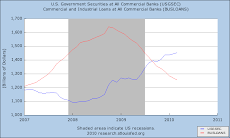

It wasn't for nothing that Greedspan was called the "Maestro". Out of thin air he created liquidity and increased affordability for housing by suppressing interest rates below the inflation rate, making all those poor "cheaters", who are now being accused of taking a loans out they couldn't afford, into houses they couldn't afford, because the real value of their savings were being sapped; money they couldn't afford to lose. The so-called negative savings rate is always blamed on bloated, selfish American greed, but that's a lie. By lowering the interest rates to less than the inflation rate, the citizen's of the US were having their savings slowly bled away from them. In an act of desperation to maintain some token of security for their future, as they watched the attack on Social Security as the Number one Mandate of the 2'nd Bush term, leaving them facing an old-age with no resources, they grabbed the lifeline held out from the sinking Titanic: the flailing ARMs.

Even if they couldn't afford the houses, they were told, they could always sell them when the day came, for a profit, getting a 20% annual return. Instead of their savings disappearing year by year, they would grow. The stark choice facing them, given that they had no pension, no Social Security, and no healthcare, was penury or a chance to not only have a vehicle for saving, but a place to live ... the choice was a no-brainer, as the smartest men in the room like to say, whenever they want to make you feel stupid for not taking their sage advice, yet leaving themselves enough plausible deniability. With MBIA's current lawsuit against Countrywide, we'll see just how plausible that deniablilty is in a court of Law.

This is why the markets are telling us that the property prices in the US are too high, because they've been artificially heightened to perpetuate the illusion of American Exceptionalism. But no such exceptionalism exists. The US is bound by the same laws of economics as the rest of the world: if you strip the middle class of its assets, which is what selling off the fruits of decades-long of a Democracy's labor to private interests is, then the value of that economy decreases, it's productive capacity sapped, the welfare of its citizens diminished.

As Adam Smith said in "The Wealth of Nations":

"The scanty maintenance of the laboring poor is the natural symptom that things are at a standstill, and their homeless condition that they are going backward".

The Fed can pour as much borrowed money into the pockets of the financiers that it wants to, but to the foreign lands from which those funds must flow, it has become undeniably apparent that as the onus of repaying those monies must be borne by an increasingly impoverished citizenry, the words of Adam Smith will again ring true. But, the US having already squelched on billions of dollars of their obligations, they will be different words:

"...all borrowers are put on the same footing as bankrupts, or people of doubtful credit, in better regulated countries (italics mine). The uncertainty of recovering his money makes the lender exact the same usurious interest which is usually required from bankrupts." But since those interest rates of the Central Bank regime are set to decrease, the real interest will be paid by way of higher inflation rates, even as the value of assets continues to decline, leaving the specter of a deflation running, thanks to the miracle of globalization, concurrently with a raging commodity price inflation. Welcome to the Friedmanitemare...don't worry about those troops in the street, they're there for your protection.

He goes on to state that among the barbarous nation the enforcement of contracts (read Credit default swaps) was left up to the contracting parties, which was the cause of the high rate of interest which took place in ancient times. Well, the barbarians are no longer at the gates, they are in the citadel. Which is why the Libor and Euribor are at historic highs.

Liberation from the regime of dollar hegemony must come from sovereign nations withdrawing from the global central banking system to return to national banking within a world order of sovereign nation states where monetary policy plays its proper role supporting national development goals, rather than sacrificing national development to support a network of oligarchies through transnational wage-suppression, export-led growth, and market manipulation via serial credit bubbles and Ponzi schemes designed to entrap the entire population in a web of debt, that eventually becomes apparent as nothing more than a web of lies.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment