Despite crippling losses in 2008, employees at financial companies in New York collected an estimated $18.4 billion in bonuses for the year.

Without a single Republican vote, President Obama won House approval for an $819 billion economic plan some companies found a loophole to increase a CEO’s pension by 10% to 40% – even as those very same companies slash pensions for their employees, The Wall Street Journal reported.

The fund (IMF) said that credit losses from bad assets originating in the US would be $2,200bn (€1,662bn, £1,537bn), a sharp increase from its previous $1,400bn estimate.

Banks would be likely to need at least half a trillion dollars in new capital over the next two years simply to prevent their capital position deteriorating further.

(Reuters) - U.S. government officials seeking to revamp the financial bailout have discussed spending another $1 trillion to $2 trillion to help restore banks to health, the Wall Street Journal said, citing people familiar with the matter.

federal regulators on Wednesday guaranteed $80 billion in uninsured deposits at the powerful institutions that service the nation's credit unions. Regulators also injected $1 billion of new capital into the largest of these wholesale credit unions, U.S. Central Federal Credit Union of Lenexa, Kan., after the firm on Wednesday posted an unexpected $1.1 billion loss for 2008. U.S. Central serves essentially as a main clearinghouse for the others in the network.

Officials are wrestling with how to privatize the gains and socialize the losses.

Geithner is the worst of Obama's picks.

California State Teachers' Retirement System, own 10 office buildings in Austin, including the Frost Bank Tower downtown.

The commercial real estate mess is just beginning. Uncollected tax bills are going to soar, and many small to mid-sized regional banks heavily into commercial real estate are headed for bankruptcy.

Hess reports a 4Q08 loss in the oil refining business. Boeing blamed their 4Q08 loss on the unions. Wells Fargo dropped $2.6 billion, which it blames on paying too much or Wachovia. Elsewhere, money sent home by Mexican guests working in the US declined for the first time ever.

The Executive Director of the UN Office on Drugs and Crime is quoted as saying "In many instances, drug money is currently the only liquid investment capital".

Europe's third-largest oil producer Total SA (ADR:TOT), offered $503 million to buy UTS Energy Corp., a Canadian oil-sands explorer. If UTS and its shareholders accept, it'd be Total's third acquisition of unconventional assets since July, Bloomberg reported. UTS shares rose more than 95% on the Toronto exchange on the news.

The Chinese premier, Wen Jiabao, left little doubt that Beijing blamed the United States for the economic breakdown. “Inappropriate macroeconomic policies,” an “unsustainable model of development characterized by prolonged low savings and high consumption,” the “blind pursuit of profit” and “the failure of financial supervision” all contributed, he said.

The most panicky of all, Mr. Roach said, are American consumers, who are retrenching after a decade-long binge fed by inflated housing prices. He predicted that they were only “20 percent into a multiyear” adjustment that would leave them much more frugal.

As many as 40 of the biggest 100 buyout firms may collapse by 2011 as their debt-strapped assets default, according to a 2008 report by Boston Consulting Group Inc., which didn’t identify the firms in its study.

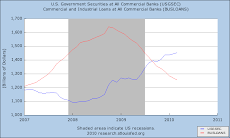

IMF in January 2009 expects total writedowns on U.S. originated assets to reach at least $2.2 trillion from the current $1 trillion (projected as recently as Oct.'09). Raising the needed amount of capital will be difficult going forward--> IMF estimates global capital shortfall of $500 bn forces banks globally to contract credit by a multiple of that amount (i.e. about 4-5 trillion using Greenlaw/Shin/Hatzius/Kashyap methodology) --> we're only half-way through.

FDIC: Fraud Delivers Inexcusable Criminality.

FOMC: Feds Orchestrate Machiavellian Coup d'Etat.

Thursday, January 29, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment