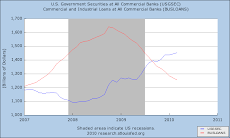

"Throughout the year – and despite global market and economic recoveries – the Federal Reserve held short-term interest rates down at near zero. Importantly, Fed holdings of mortgage-backed securities ballooned from nothing to end the year approaching $1.0 TN. This unprecedented monetization reliquefied markets, pushed mortgage borrowing costs to record lows, fueled a refinancing boom, and worked surreptitiously to transform hundreds of billions of problematic “private-label” mortgages into (market-appealing) government-backed securities."

As stated above by Doug Noland of Prudentbear.com the government is the Market for MBS, which should now be more-accurately referred to as GBS.

Right now, eg, there are people with 2-income households, no kids, yet so hopelessly underwater they've stopped paying the mortgage. This results in a $50k interest deduction for which they are no longer eligible .. the banks may not be getting their money, but guess who is? The Federal govt and the States. The real ($$$) reason for the Fed's forbearance of accounting legerdemain.

In a quote by Andrew Jackson posted on the IRA's web-site (http://us1.institutionalriskanalytics.com/pub/IRAMain.asp), the crux of the crooks' methodology is revealed to be as old as what used to be referred to as "the Union":

"Experience should teach us wisdom. Most of the difficulties our Government now encounters and most of the dangers which impend over our Union have sprung from an abandonment of the legitimate objects of Government by our national legislation, and the adoption of such principles as are embodied in this act. Many of our rich men have not been content with equal protection and equal benefits, but have besought us to make them richer by act of Congress. By attempting to gratify their desires we have in the results of our legislation arrayed section against section, interest against interest, and man against man, in a fearful commotion which threatens to shake the foundations of our Union. It is time to pause in our career to review our principles, and if possible revive that devoted patriotism and spirit of compromise which distinguished the sages of the Revolution and the fathers of our Union. If we can not at once, in justice to interests vested under improvident legislation, make our Government what it ought to be, we can at least take a stand against all new grants of monopolies and exclusive privileges, against any prostitution of our Government to the advancement of the few at the expense of the many, and in favor of compromise and gradual reform in our code of laws and system of political economy."

Google shut down another financial blog, while Bernanke, the high priest and prophet of the insanity of waste Capitolism has descended to, referred to the "savings glut" again... ie we peasants are no longer allowed to have savings accounts, but are instead advanced "credit", the terms of which can be changed at any time, for any reason, by the credit-issuing institution, granting the government, which now runs these same institutions, co- conspirator status with banksters, whose now-obvious odious intention is to enrich themselves and utterly impoverish their customers by confiscating their wealth via usurious interest payments, and other financial hidden traps, cogently referred to as "innovations", that lie waiting like beartraps, armed with brutal teeth and buried out of sight in small print, to tear the flesh and break the bones of their clientele.

Meanwhile, in The Huffington Post, a "Move Your Money" campaign has been initiated, in which, working with the IRA (institutional risk analytics), a list of more than 5000 banks is used to encourage flocks to move their savings to fundamentally sound institutions and away from money center banks, the true scope of the disaster that continues is made apparent. The one great innovation of the aughts was the ATM, but, of course, the smaller banks don't have the financial clout to have any. Every single one listed for the zip code I plugged in, which was in a major metropolitan area, necessitated a trip downtown whenever I should need cash, as they had no other branches.

Of course, that's only one problem. The main one being that, like all industries since the rise of the internet and financial computerization, should those banks become profitable, the well-financed mega banks will simply buy them up, since they have unlimited access, via the largess of their friend Benron, to the printing press of the US government.

Because without Capitolism, there is no capitalism. What the debacle should have shown us is that without the government's presence in the markets, chaos reigns, and as Martin Wolf stated, we can not "even take the survival of civilisation itself for granted."

Yet, as he goes on to say, "the financial system remains damaged. Not only does it still own vast quantities of the “toxic assets” its “talented” employees created, but the world is not addressing the structural causes of the crisis. In some ways, the oligopolistic banking system that has emerged from the crisis is riskier than the one that went into it."

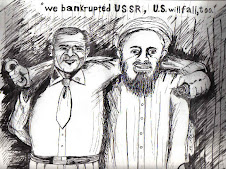

It is with this backdrop that we blithely re-appoint the smug, over-confident, self-congratulatory fool that presided over the entire globe's slide into a chaos so stark that the survival of civilization itself was in question. To repeat the same actions and expect different results is the very definition of madness. Remember this when the government is incapable of stopping the slide to catastrophe when the next crisis, engineered by the same crooks and charlatans, aided and abetted by the same fool, strikes again.

Friday, January 1, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment