|

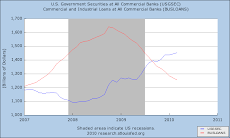

| The Finance Seers predict we lose. |

In an article entitled, "A Backlash in Europe Has Politicians Calling for a Goldman Ban", the WSJ writes that Goldman Sacks (and Pillages), "is in danger of losing business with a key group of clients as a result of the fraud allegations it faces: governments in Europe and the U.S."

Reading that reminded me of something:

In Theodore Dreiser's epic tome The Financier, he tells the story of Frank Cowperwood, a not-quite rags-to-riches saga of a banker's son who deciphers the financial subtleties of Philadelphia's City Treasury in such a way as to work its mechanism to provide him, and those in government who aid and abet him, with a substantial fortune, lifting them out of a humdrum, and for some, marginal, existence, into undreamed of luxury (well, not quite undreamed of).

Dreiser explains how the city of Philadelphia allowed the Treasurer to lend quite freely from the City coffers to certain brokers and dealers that sold the City's debt, and how our hero, Cowperwood, by manipulating the market on 'change, was able to get the City's debt to sell at par, whereas before his manipulation, it could be brokered for 80%, at most. This legerdemain left the Treasurer breathless and quite agog at the Wunderkind he'd unearthed. And because the Treasurer was allowed to make loans at no interest, since, for some reason, the city allowed those banks it used as depositories to return any amount allocated without paying interest on it, the better Frank Cowperwood could leverage the amounts loaned to him, the more money he could make, and instead of paying the City the interest, he could pay the Treasurer, say, 2%, and everybody's happy with no one the wiser.

So for years Cowperwood ransacked the Treasury's funds, buying up streetcar lines, setting up dummy corporations and using wealth to create more wealth, not of course, for the Commonwealth, even though it was in fact the source of his success, but always as it ever is, to pad his own pocket and those he knew in government who were allowing his defalcations to occur.

He became more and more extended, using larger and larger loans to buy up more and more of the public's property for his own use, using the very same public's funds, until one day in 1871 the City of Chicago caught on fire, and the entire financial district was transformed overnight into a smoldering pile of ash.

Now up to this point Cowperwood's ascendancy did not go unnoticed amongst the city's denizens, but, "all of the newspapers were so closely identified with the political and financial powers of The City, they did not dare to come out openly and say what they thought. It would not be good for Philadelphia, for local business, etc, if they were to make a row. The fair name of The City would be smirched. It was the same old story."

Because the devastation in Chicago was so complete, it resulted in a concatenating failure of insurance companies reaching as far as Philadelphia and exposing the huge risks sloughed onto the public by the profit-hungry banks and brokers ... it was a time, "when all the little rats and mice were scurrying for cover because of the presence of the great, fiery-eyed public cat somewhere in the dark, and only the older and wiser rats were able to act."

However, while the Treasurer's face "was grayish-white, his lips blue", Cowperwood never lost his head; that "thing called conscience, which obsesses and rides some people to destruction did not trouble him at all. Good and Evil? Those were toys of clerics, by which they made money ... Something - he could not say what - it was the only metaphysics he bothered about - was doing something for him" (as he went about doing God's work?).

Yes, in the parallel that's evident here, the citizen is now, thanks to our illustrious Supreme Court that bestows on an amoral fictitious entity the same rights but none of the responsibilities of a person, Goldman. The Goldman's that is indeed culpable of all the same crimes as Cowperwood, but will pay none of the penalties - you cannot send a Corporation to jail, which is where Frank Cowperwood ends up, as does the Treasurer, both of whom are thrown under the bus by the true reigning financial powers of the City, who walk away unscathed.

Before he passes sentence on our feckless duo, the judge addresses the Treasurer thus:

"The misapplication of public moneys has become the great crime of the age. If not promptly and firmly checked, it will ultimately destroy our institutions. When a republic becomes honeycombed with corruption its vitality is gone. It must crumble upon the first pressure.

"In my opinion, the public is much to blame for your offense and others of a similar character. Heretofore, official fraud has been regarded with too much indifference. What we need is a state of public opinion which would make the improper use of public money a thing to be execrated. It was the lack of this which made your offense possible.

"The people had confided in you the care of their money ... a high and sacred trust. You should have guarded the door of the treasury against everyone who approached it improperly. Your position as the representative of a great community warranted that."

Hopefully you've noticed that those words, although in much need of today, are not being, and will not be, uttered. Instead, the head of the Central Bank is running the Fed's balance sheet the same way that Citi and other TBTF institutions ran their books: like a SIV, and doing so aided and abetted by the very Treasury that's disregarded its "high and sacred trust", and has, instead of "guarding the door against everyone who approached it improperly", has flung it open to be ransacked by fraudsters and embezzlers.

And, now that the WSJ, which was one "of the papers that were so closely identified with the political and financial powers of the Citi that they did not dare (care) to come out openly and say what they thought (knew), for years after the malfeasance that they trumpeted as American Exceptionalism so loudly during the boom, comes out to throw Cowperwood, oops, I mean Goldman's, under the train to hide their own and government's and OUR involvement in this confederacy of dunces' dance that even the Citi's Prince couldn't sit down from until the FED stopped playing the music. (At which point they did chuck Prince, but only after awarding him more than $40 million from money amassed by systematically defrauding the entire globe).

| ||||

| Rich man poor man, the Prince and the pauper, One's hired by Goldman, the other, evicted by a Copper. |

Yes the FED. Because, without the backing of gold, it is only the full faith and credit of the Sovereign state of the US Government that backs our dollar. Banks are no longer the independent financial institutions that we all like to keep on pretending that they are: they are mere vassals of the Fed, GSE's completely lacking in resources until the Fed waves its magic wand and creates them. This while they promulgate dogma advocating "free markets" and idol-worshiping "entrepreneurship", as they work to undermine both.

City and government officials on all levels were completely enmeshed in the financial legerdemain taking place. "The Financier" should be required reading in every high school in America. Instead we have them reading "The Great Gatsby" and "Grapes of Wrath", illustrating the perpetrators and the victims, leaving our students without a clue of the methods used by the Gatsbys of the world against the Joads. These methods are brilliantly and clearly set out in Dreiser's book, which, if read, would prevent the Superclass from using the same old tricks with no one the wiser, except the Chairman of the Fed who instead can stand in front of the citizens and claim he never saw the largest financial disaster of the century speeding down the tracks, coming straight at him with both the visibility and the inevitability of a locomotive, at both him and the people it was his bailiwick to protect.

He still got re-appointed.

While everyone's playing "Monopoly", Benron Bernankie knows that the real action is the game of "Risk", namely, how to hide it so you can dupe others into taking it on unbeknown to themselves: it used to be called fraud, now it's called "financial innovation".

And by perpetrating it the agents of the federal government, agents to whom we pay generous salaries and benefits, unavailable to those toiling in the private sector who pay their generous wages, supposedly in order to keep temptation at bay, have squandered the trust of the world (but not ours: Bernanke, Summers, Geithner, Rubin ... they are all still in power) and you will reap the whirlwind because of their treachery, while they, as with the Goldman case, will use sleight of hand to slough the blame onto their agent, that, as in Greece, merely did their bidding, making the Goldman all the richer and us that much poorer.

No comments:

Post a Comment