"I speak of peace,

while covert enmity

under the smile of safety

wounds the world."

~~ William Shakespeare

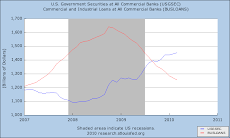

IN an article on Daily Reckoning.com, entitled, "Banking Profits in a Beaten-Down Market", Chris Mayers exhorts readers to buy into the banking sector, and profit from its privileged Federal government-protected position of ascendancy within the Free-for-all market place in which Laissez-faire, the devil's philosophy, has been replaced with, 'Where's my share?' governance. Whereas the former was simply a way of saying that those put in positions of authority in order to govern, instead do nothing, the distress their constituents thereby suffer need not bother them but can be completely disregarded, the latter demands a cut in order to get the favors Corporations need from government in the form of decreased regulation, bought judges, or Title Deeds reshuffled (leaving us at their MERSy).

Asking such questions as, "Should we write off an entire industry because of bad things that happened to it five years ago?", and, "Are we interested in making money? Or do we want to assemble prettily wrapped portfolios of stuff other people will like??"

Really? Bad things? And these bad things just happened to it?

Of course, what he means is, given free rein to run amok with scads of free money and allowed to practice Enron-style accounting tricks of fraud whereby enormous sums were expended on risky ventures for which the banks' liability (they thought, but, ohhh, were they wrong) was shoved off its books onto SIV's, and miraculously turned into assets so that the price of the stock would, by design (hence the fraud, this was not merely rehypothecation, (a term used by bankers to hide the fact that the basis of their earnings' model is basically embezzlement), but planned deception of not only its investors and regulators, but its depositors, as to the relative safety, and therefore, enhanced or diminished interest/dividend payments expected), enable them to pour money into their own pockets by keeping it out of yours. They were so clever, however, and their chicanery, woven like a fine tapestry of spun glass, its opaque secrets delicately obscured behind such beautiful arabesques of stunning complexity, was so breathtakingly intricate, that they felt they had the right to simply take whatever they quanted to. And so they did.

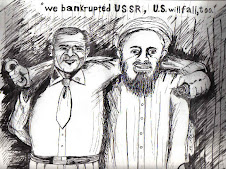

And hence, they brought the economic system crashing down to its knees. They grabbed so greedily and feasted so avidly on the combined labor of the proles they despised that in all their gluttony, in their wolfish feeding frenzy, they forgot that the system they were gaming was no game. Simply because they had no principles, they forgot that real principles exist, and to ignore them is to flirt with disaster. But they didn't care. They were hedged. At a time when "You're either with us or against us" was the overriding mood of the Bush at the center of the very government they were milking, they straddled both sides, with hedging contrived such that, should the system fail, they, at least, would profit while all their customers and fellow citizens would suffer the consequences and pay and pay and pay, the price. And all this, all the criminality, conspiracy to defraud, and bribery of politicians on every level of government, all transpired during the creation of the most rapid and costliest growth in the financial crimes division of the US federal government in history.

But, because the return on equity for the whole industry in 2012 was about 9%, while the return to the depositors of the same institutions is basically zero, and less if your bank charges you extraneous 'fees', why not put your money into bank stock where it's safer?, Chris asks. And this is what the site "Daily Reckoning" for which he writes, calls, the 'Free Market'. Where they exhort you to put your cash into stocks not because they have value or are good for the economy or the quality of life, but for the simple reason, that, since they're buoyed up with a government-guaranteed TBTF life preserver, the in-crowd crows, put your money where the Fed is.

Sounds reasonable, in a scary sort of way. But remember. FDIC insurance is real and the Fed is a duplicitous organisation, founded to protect those with capital from the consequences of their folly by using the reins of power to change rules on a whim and enforce those they choose to and ignore those they dislike. And, as pointed out by Ambrose-Evans Pritchard, not exactly a firebrand, in his post in the Telegraph:

"After almost five years we are still in a contained global depression, struggling with a world record saving rate of 25pc, and a chronic shortage of demand. The US has kept the world afloat by running down its own saving rate to 2.7pc this year. This is not a remotely tenable equilibrium. Hang on to your seats when that snaps back."

In such a world, bank stocks seem a very dubious investment indeed. If you decide to do so, though, take care you don't get trampled when the rush to the exit ensues.