|

| When the Journey is the Destination. |

It's a gorgeous day in San Francisco this Friday the 13'th. Scarily so. Which makes me think of an analogy. A couple of years ago I was coming out of a Rite-Aid, now gone and replaced right across the street by a CVS, (a block away from a Walgreens, a common phenomenon), and there was a woman cursing the unseasonable balminess of the weather, blaming it on Climate Change. Now, whereas I understand her concern, what good does it do to upset yourself over something you can't change? Why not just enjoy the beautiful day?, I wondered.

But, as this blog is evidence of, I do the same thing she was doing, and, I suspect, for the same reason. I sit here at my computer, relatively well off, I have a roof over my head, enough to eat, so, I'm often asked, what's the point of griping? Enjoy it while you can. I get it, and that is a valid point. But it only works if you don't care about anyone else. It only works if you think that this is the only way it can be. And mostly it only works if you really believe that there are not malicious forces at work, in Congress in fact, to rob you of exactly those things you've worked hard for and feel you have earned.

No matter what you may think of the cause of climate change, and it's so outrageously warm out today, in the middle of February, that it really is a moot point, this is not normal, and the fact that it's becoming so, is silent testament to the fact that it's changed, hence the term. This is not the same climate as when I moved here in the 70's. the point being, that no matter how it's been changed, nobody set out to do so. You can believe mankind's had nothing to do with it, as idiotic as that assertion may be, but I can't, in rebuttal, say that mankind's done it on purpose, whereas the trajectory of the economy and of the distribution of wealth in the USA, and now, in the rest of the OECD countries, has been done on purpose, with evil intentions, and those do need to be addressed, although not in the way they are being addressed.

Everyone knows this by now. What they don't know is how to rectify the situation, which is why on so many economic blogs, you see the phrase "Lehman Moment", in lieu of the pre-financial-crisis term, "Minsky Moment", but they both have come to mean the same thing, to whit, a collapse of leveraged debt instruments precipitated by the casual, even careless, assumption of risk on the assumption that the way things have been going is the way they will keep on going. A kind of somnambulance of not only the population that has been mesmerized into their stupor, but of the financial elites who rigged the system in order to keep their enormous flows of currencies, from which they skim a larger and larger (as everything in a Capitalist society, from government bureaucracies to the ponzi scheme dynamics of hedge funds) percentage off into their own wealth preserves, such as land, precious gems and stocks in emerging markets, ie diversified out of their own country's currency into safer havens, or at least what's perceived as such, which of course, has the expected and calculated result of destabilizing those currencies, because if you deem it a safe haven, it is completely impossible that other astute observers of the economic nightmare we've created aren't going to come to the same conclusion.

That nobody understands money anymore is best illustrated by trying to make sense of economic opinion mongers like the NYT's Mr. Paul, the Krugmaniac of fiscal imprudence and Fed largess, who time and again demonstrates his complete lack of understanding of how the banking system works, with today's column no different, as he rails against the other Mr. Paul, the Rand-y one named for an Ayn and echoing a Ryan who rants like an Aryan. Arguing senselessly that the Fed can't be like an overleveraged bank because its liabilities consist of cash (all banks' liabilities consist of cash), the Fed, like any CB, is simply the bank of last resort, and if it has no well, cash, Mr. Paul, then what occurs is a credit crunch, a liquidity freeze, a ... well, Bank run. Only this time it's the Central Bank to which all of its member banks are running to to cover their positions of badly placed bets that were entered into because of the largess of that same CB/Fed, that has now decided to withdraw it. Or, in the parlance of the financial industry itself, has "taken away the punch bowl", a term that should (but apparently doesn't) put an end to any fantasies of sober-minded banksters. They act, as evinced by their own rhetoric, like a bunch of drunken sailors. The rum they imbibe, however, comes in the form of easy money and implicit backstopping of their reckless investments by an out-of-control printing press.

Anyone knowledgeable about the economic system and how it works knows that this is the dynamic by which the monetary officials direct, analogous to Fanny Mae and Freddie Mac, investment funds, by manipulation of the interest rate. This, despite Mr. Paul's snide assertion that conservatives are, oh just crazy because they believe that "Modern Money" (he never explains what exactly is meant by modern, as opposed to, what, old-school money?) is defined by conspiracy, which, as in the Freddy/Fannie, scenario, it is. Their bonds were paying more interest because a consortium of private and public "servants" decided that a certain segment of the population should get loans for which there was an increased risk that they would default on them, yet they would be extended regardless, and the liability, should those loans default, be borne by, not just other purchasers of homes, which is what would naturally occur, (via the mechanism of increased interest rates and/or larger down payment, both of which were impossible because the buyers the industry had targeted could afford neither unless they were manipulated downward) but by the other taxpayers who haven't bought homes as well, via the mechanism of Nationalization. This is the exact nature of conspiracy, as those other taxpayers, whose backs were the ones to bear the brunt of the risk, were completely unaware, in our great Demokracy, of what was being done in their name.

Pollyanna then continues to ridicule the conservatives for believing that money is the "base of a moral existence". So here we have a self-proclaimed "conscience of a liberal" castigating others for thinking there is a morality that is associated with the creation and distribution of money, leaving one to wonder just exactly it is that makes Mr. Paul lean left if it isn't the belief that there is a lack of morality to the inequality of income distribution? And if the moral dimension to money is just something to deride, since one could arguably maintain that the only reason for the Krugmaniac's stance on income distribution is rather one of necessity, as how can you run a consumerist economy when the consumers you count on for buying your goods are either bereft of funds or left without any time in which to spend them, then, the very name of his blog belies that fact, because a conscience, by definition, declares a moral dimension to the sphere of economics that any Classical Economist would be the first to treat with the same derision the Krugmaniac resorts to when his arguments lack any semblance of intellectual rigor.

Now why do I let Paul Krugman get to me like this, I've started wondering? Other economists say things just as feckless. But Jim Cramer, for example, doesn't pretend, well, not well enough to believe that anyone, least of all himself, thinks he's anything but a shill. But Krugman writes for the NYT, for Chrissakes, and all he gives us is party-line blather. He wants the hoi polloi to leave it to economists like him, who've never had to dirty their hands balancing a ledger, or meeting a payroll, insist that their sphere is so celestial that mere mortals like us can't comprehend the complex issues that complicate the subject, and worse, he's convinced it's a waste of time for us to even try. So instead he engages in the worst type of intellectual pandering to the prejudices of the office-clerk, and limo liberals who deride any utterances from the underclass represented by tea-party republicans and their mouthpieces, characterizing it all as mindless drivel.

In other words, it's his blatant dishonesty, cloaked in the shibboleths of liberal economic theory, that distinguish Krugman as as big a con man and media hog as Sen Inhofe, and just as dangerous. Just as blind and unreasoning as Inhofe's insistence that only god can raise the temperature of the earth is the idiocy maintained by the entire economic profession, (well, not Gail the Actuary, Ilargi, of Automatic Earth, or Yves Smith of Naked Capitalism (all women I notice)) take the in-doctrinaire step of admitting that energy resources are not just another commodity, but, like water, are in a class by themselves when it comes to economic life, (as water is when it comes to biological life and its processes) that energy, and specifically oil, are simply terms to be plugged into their equations and then Voila, everything's fine again. How this differs from Inhofe's obstinacy escapes me. And not just me. When you tell a non-economist the fact that oil is considered just one other input to economists' models, like iron ore, they quite literally don't believe it. And you know what? Neither does Krugman. Sean Hannity, now he might. He's obviously that stupid. But Bill O"Reilly? No. He's maybe Krugman's doppleganger on the right. He knows better, but it's his business to sell an accepted idea to those already convinced of it, as Krugman does for the left, the difference being that even O'Reilly has come fairly close to admitting it, whereas Krugman, given the more totalitarian bent of the left wing, using "Political Correctness" as a tool to shut up dissenting voices, is straight-jacketed into his role as advocate for the middle class and economic growth via stimulation by Federal Government outlays of money it doesn't have, by assuming even more unpayable debt, and then to simply inflate our way out of ever having to pay it back in anything close to the amounts actually borrowed. (Which would explain, as none of the official excuses do, our insistence on allying ourselves with yet another one of the most corrupt regimes on the planet, Poroshenko's Ukraine, which, "If you want accounts diverted, storage spaces emptied, black markets stocked, then you call in the experts. Good old Ukrainian corruption will make business entities appear and disappear at 30 frames per second. They can channel diverted monies downstream or upstream in any parallel or perpendicular universe you want. Traditional forensic accounting from the big western banks is rendered completely useless to Ukrainians. This is a land where quadruple book accounting is standard because it is common to steal from the tax man and the boss and the one who thinks he is stealing as a partner, while also keeping track of reality in the fourth book. Adding a fifth and sixth level to fool the various paymasters and contractors from the US will be like taking candy from a baby".

Perhaps adopting this kind of Ukrainian accounting is just fine with PK, as in the middle of his column, he asks, if it were true that the Fed engineered its policies in order to do monetarily what the Congress was neglecting to do fiscally, "is this supposed to be a bad thing?" According to Luis De Sousa, among others, the answer is, "Yes!".

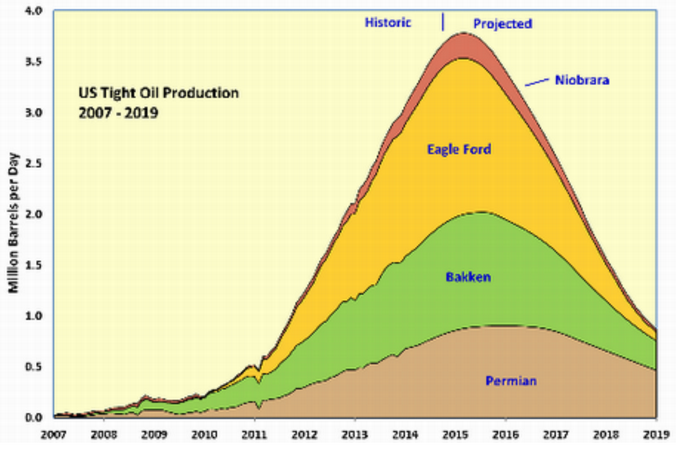

Fed funny-money doesn't work the same as money that is actually accounted for via the process of allocation and disbursement. It takes other channels, and those channels all lead to high risk ie, speculative, investments, because, in a ZIRP environment, where else would you put it? Back into the government bonds that the Fed bought in order to generate the "cash" to begin with? Bonds that, btw, pay less interest than the Fed's projection of inflation in the intervening years between when they were bought and when they reach maturity, so yes, it is a bad thing, and in terms of climate change, it is a disastrous thing, as shown via the fracking diagram below from Souse's article on the shale sub-prime:

One that's closely related to the other subprime problem: car loans, where close to 40% of those loans were extended to sub-prime borrowers in the last quarter of 2014. This sets the stage for the next crash as the rig count plummets, which translates into future production levels decreasing even as the US consumer, and somewhat worldwide, changes their purchases to larger, less fuel-efficient models, guaranteeing a supply-demand mismatch in the not-so-distant future, as consumers once again are stoked into making misinformed purchases.

It is precisely the policy of Free Trade and Globalization and reckless monetary expansion undertaken by CB's worldwide that is responsible for the acceleration in the rate of Climate Change such that changes that were not projected to occur until the end of this century are occurring instead at its outset. Changing the entire continent of Asia into a grasping, energy-hungry behemoth of middle class aspirants numbering in the billions of people in order to export our inflation, our pollution, and our dollars out of the US economy was perhaps not "supposed to be a bad thing" but it was. And the drilling of thousands of wells, causing earthquakes where there never were any and wreaking havoc with the world's oil supply wasn't supposed to cause another financial collapse, but that's what it did. We just don't know it yet, just as in 2005 we didn't know we had reached peak oil production of conventional oil, but we had, nor that that it would result in a financial collapse that would take down every investment bank on Wall St., but it did.

And yet we changed nothing. We doubled down our bets instead. Instead of addressing the increased impoverishment of the vast majority of mankind and attempting to create an economy that might, at least nominally, lift them, or some portion of them, out of total misery, we insist on the pretending to believe that the way things work now is the way they will continue to work and that that is a good thing, and PK is as much an advocate of that mindset as the people he derides, only PK should know better. Does know better.

In a post in August, 2009, I wrote,

In September, in New York, in a marble-fronted, colonnaded building on Wall St that's wrapped itself in an enormous US flag, that both hides and scurrilously boasts of its scoundrel's heart, there was a sudden crash that was heard throughout the world. The dead and worn out husk of the economy that was had been cracked and split right down the middle. But the living, changing, suffering thing within- the real economy- the one that has yet to be, began slowly to emerge. It came forth into the light of day, stunned, cramped, crippled by the bonds of its imprisonment, and for a long time it'll remain in a state of suspended animation, full of latent vitality, waiting, albeit impatiently, for the next stage of its metamorphosis.

But this next stage was never given a chance to emerge. So much was dependent on the old ways, so many promises had been made that no one knew how they could be fulfilled, so that instead we let ourselves be brainwashed with word magic: "Conditions are fundamentally sound", they said, "I don't anticipate any serious problems among the large, internationally active banks that make up a very substantial part of our banking system", the Fed chairman intoned - by which words they meant to reassure themselves that nothing now was really changed, that things were as they always had been, and how they ever would be, Wall St without end, amen", into thinking that an economy that was continuously degrading the lives of the citizens at its very center who were its most staunch advocates, would somehow change and make prosperous, or even livable, all our lives in the years that were to follow.

But they were wrong. They still do not know that you can't go home again. The USA, and the world, came to the end of something, and to the beginning of something else. But no one knows what that something else will be. Now out of the carnage and the uncertainty, the wrongness of the leaders, grows fear and desperation, and hunger and despair stalks the streets.

The collapse of Lehman's was like the fall of a gigantic boulder into the still waters of a lake. The suddenness of it sent waves of desperate fear moving in ever-widening circles throughout the world. Billions of people still do not know what to make of it, and the waters of the lake have closed over the fallen boulder while most people have gone about their daily work just as usual.

But the waves of fear have touched them, and life is not quite the same. Security, even the sense of it, is gone, replaced with dread and an ominous foreboding in the air. It is in this atmosphere of false calm and desperate anxiety that Obama began his presidency. He had seen the boom-mad economy tottering on the brink of ruin. He had read in the eyes of people on the campaign trail the fear and guilty knowledge of the calamity that was impending and that they are still refusing to admit even to themselves ... especially to themselves.

He knows that they are still clinging desperately to the illusion of paper riches, and that madness such as this is unprepared to face reality and truth in any degree whatsoever. This gives him a premonitory consciousness that he is in for something. For, the "birthers" notwithstanding, he is an American, and, unlike his silver-spooned predecessor, he knows that there's something wounded about America. He knows that there is something twisted, dark, and full of pain which Americans have known all their lives - something rooted in our souls beyond all contradiction, about which no one has dared to write, of which no one has ever spoken.

That this destination is perhaps not one worth working your entire adult life to attain should be called into question by the very fact that the current feel-good formula for bearing the burden of thankless employment has become,"The Journey is the Destination", so you should enjoy the commute, because you're never going to get to where you're going anyway. But perhaps that's it, perhaps it's called a dream for a reason, and we've been lullabied into believing the children's rhyme that "Life is but a dream", so we shouldn't be surprised when it doesn't turn out as we expected, because dreams never do. But it still seems to me that the endgame doesn't have to be nearly as dire as it's promising to be. All we have to do is dream of a different life, admit that the old dream was never all it was cracked up to be in the first place. The reality of constant war and citizen surveillance as the new normal should be stamping a large "FAIL" on our current way of doing things, but instead we intensify the two, such that the only thing our politician's promises really pan out to is that this is not as bad as it's going to be. It will only get worse. So Buckle your seatbelts, folks, it's not only going to be a bumpy ride, AsiaAir is piloting the plane.

No comments:

Post a Comment